Sunshine Profits Methodology Simplified

Our work can be divided into several parts, all of which are essential in order to provide you with valuable commentary along with detailed Speculative Model Portfolio. This is exactly the same methodology that we use when making crucial decisions regarding our own portfolio.

As you may see on the diagram above, we almost always start with the mix of fundamental and technical analysis. Either news, fundamental factors and/or the price action itself gets our attention. We analyze the situation and look for confirmation or non-confirmation by other factors. Sometimes we find that the situation can be profitably traded and/or changes our preferences towards our long-term holdings. If we see that the risk to reward ratio is appealing, we investigate further before making any decisions or sending an update to our Subscribers.

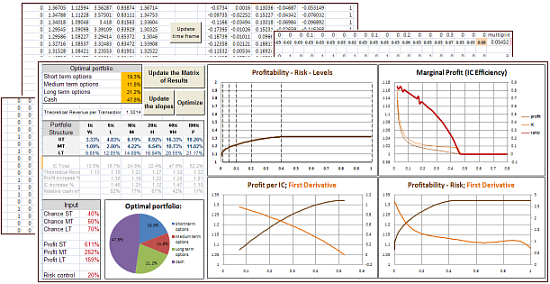

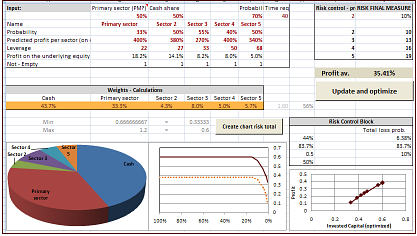

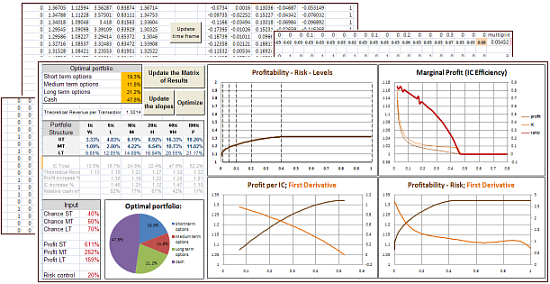

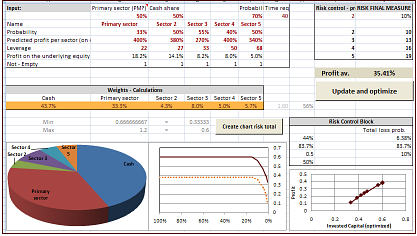

Contrary to many analysts, who end their work here, we are able to put our predictions and expectations into mathematically optimized form thanks to the models that we created.

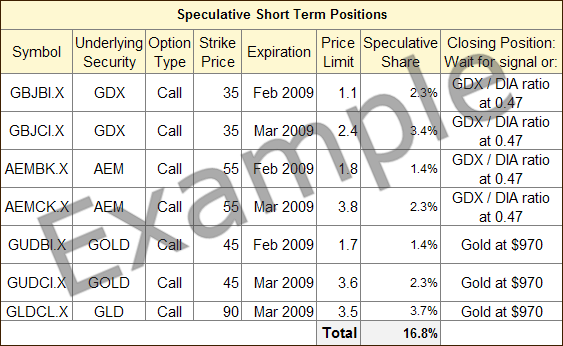

We have constructed two models, each designed with different strategy in mind. The first model is dedicated to profiting on call or put options for one sector or stock, whereas the second model is used to decrease risk and/or increase profits thanks to diversifying into several sectors. Both models were designed with the long-term success in mind, unlike most similar models, which focus on just one-trade or one year. We combine unique characteristics of both models before providing you with our Speculative Model Portfolio.

Still not sure about using the Premium Service?

![[Most Recent Charts from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_4.gif)

![[Most Recent Copper from www.kitco.com]](/files/idx24_copper.gif)

![[Most Recent XAU from www.kitco.com]](/files/idx24_xau_en_2.gif)

![[Most Recent HUI from www.kitco.com]](/files/idx24_hui_en_2.gif)