"Risk is good. Not properly managing your risk is a dangerous leap." - Evel Knievel

What you find here, is different from essays in the research section, as it contains information, formulas and programs in an easy-to-use and exceptionally practical form. Just click on a tool, which best suits your current needs and enjoy the results of our work. If you have problems using our tools, click here for troubleshooting.

Click here for the sample version of the "Leverage Calculator - Gold" tool.

| The Leverage Calculator - Gold No matter if you are choosing gold stocks to your long-term porfolio or if you have a particular short-term trade in mind, this tool will do the "heavy-lifting" for you. Would you like to get a list of gold stocks (you many select your favorites or go with the most popular ones) ranked in the order of their leverage and exposure to gold? With this tool it's only a few clicks away. Naturally, you will get to see details, not just the outcome. Click here for instructions. You can access the demo version of this tool here |

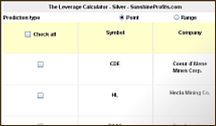

| The Leverage Calculator - Silver No matter if you are choosing silver stocks to your long-term porfolio or if you have a particular short-term trade in mind, this tool will do the "heavy-lifting" for you. Would you like to get a list of silver stocks (you many select your favorites or go with the most popular ones) ranked in the order of their leverage and exposure to silver? With this tool it's only a few clicks away. Naturally, you will get to see details, not just the outcome. Click here for instructions. |

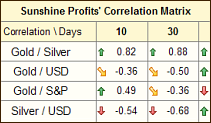

| The Correlation Matrix With this tool you can then check what are the key markets that may have the biggest influence on the sector that you are interested in (metals, PM stocks, juniors) in coming days/weeks/months. It should prove particularly useful in detecting the catalyst for either breakout or breakdown, which consequently should increase the odds of making the correct decision regarding your portfolio. We have dedicated one of the essays in the research section to this type of analysis. |

| Top or not? Is this the ultimate top? Is it a top at all? In this tool we provide a list of questions that might help you notice sings of a coming end of the precious metals bull market. We also present similar questions helpful in determining local tops. This list is going to get more and more useful as the bull market continues. |

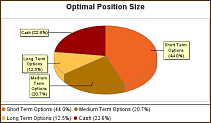

| The Position Size Calculator allows you to truly excel in your options trading, by adjusting sizes of positions according to your detailed views on the market. It gives special attention to long term success of your portfolio and makes sure that taking more risk is justified from that point of view. We use this tool very often ourselves. Please read instructions to find out more. |

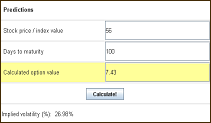

| The Option Pricing Model This is the basic Black-Scholes options pricing model. There is many calculators on the Internet similar to this one, however our version has been designed specifically to help you make quick simulations. "What happens if this stock goes down 87 cents?" question gets answered very quickly - and during a volatile session time is a very important factor. Click here for instructions. |

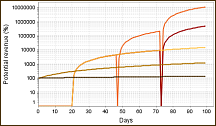

| The Pyramid Optimizer Here's how pyramiding makes you money - i.a. you buy call options on a stock that you expect to rise. When you achieve a substantial profit on these options, you sell them and use the proceeds to buy call options on the same stock, but at the higher strike price. You can repeat this scheme, as long as the stock does not reach your price objective. "How can I do it?", "How much can I gain?" "What strike prices should I use?" - all of these questions (and more!) can be answered through this powerful tool. This tool will also tell you if pyramiding is not a good idea for a particular situation. Click here for instructions. |

We have successfully tested and use all tools, which we have developed, however we do not guarantee their accuracy. Each of the tools may be used for entertainment and educational purposes only.

![[Most Recent Charts from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_4.gif)

![[Most Recent Copper from www.kitco.com]](/files/idx24_copper.gif)

![[Most Recent XAU from www.kitco.com]](/files/idx24_xau_en_2.gif)

![[Most Recent HUI from www.kitco.com]](/files/idx24_hui_en_2.gif)