The Universal Investor. Speculation and Investment

The purpose of this article is to emphasize the

advantages and explain the logic of combining investing in different time

horizons. Some thoughts on choosing the appropriate position size will also be

presented.

We have

received many messages from our Readers after publishing the previous essay about predicting corrections in the precious metals. We have been both praised

and criticized for suggesting that using options might be very useful for gold

and silver investors. The argument that is commonly used is that ‘I am not a

speculator, I don’t gamble with my money, I stick to the long term’. In our

view, investing in the long term is a very good idea, suitable for many

investors, but it’s not the best idea. This essay is dedicated to explaining

the logic behind the above opinion.

We think

that the methodology used in this article may be applied to all markets,

however it might be particularly useful to precious metals investors. In our

view, the precious metals sector is characterized by a specific, cyclical

nature and presents unique opportunities for speculators and traders. One of

them was featured in our previous essay.

Usually

when we take a book, brochure or even an essay written by an analyst or a

salesperson who deals in investments, we see a host of hidden assumptions that

are presented as facts. Some of them are easy to recognize like "this market

is going to double within 3 next years" or "that company is

undervalued" (based on just one method of valuation), some are much more

difficult to spot. Usually author of a particular publication is advocating

investing in only one time-frame. Rarely do authors combine different

approaches towards investing. Partly, it's a matter of specialization, which

enables individuals to focus on and master just one approach towards investing.

On the other hand, however, it means that one is likely to miss out on

opportunities that only combining strategies including different time-frames

can provide. Authors often overlook this fact and state that "only

investing long term can make you rich" or "in the long run we're all

dead - investing short term is what you should do." Following analysis or

advertisement is based on respective author's belief that one time-frame of

investing is superior to the other. Such beliefs are exactly what was earlier

described as "hidden assumptions".

Which of

these assumptions are correct? Which are false? Neither? Both?

Generally they are both correct. The answer is more complex than

it may seem at the first glance. There are numerous books on investing

available to purchase for an individual investor. Some of them include strategies

of different successful investors or speculators. Many of them made fortunes on

day-trading, while others got rich thanks to buying early in the bull market

and "sitting tight" all the way to the top. Some of these investors

think that in the long term markets follow fundamentals, are logical and

therefore predictable in that particular time-frame. Other, especially fans of

the chaos theory, claim that only short-term price moves can be predicted with

significant precision. The accuracy drops off substantially along with

forecast's time. Both of these views seem to be supported by a group of

successful investors. How can they be successful at the same time if they

represent different views on such critical topic? The answer could be that some

people are best in managing risk and their own emotions but on the other hand

are not very patient, while others have exactly opposite skills. What is really

important is how we can use techniques of both parties to optimize our own rate

of return. People who speculate in the short term tend to limit the size of

their position, even to a couple of percent of their total investment capital,

while long term investors usually use a large share of their portfolio, keeping

only a small part of money in the form of cash. Some of them invest all of

their money. Again, are they really right at the same time?

One more

time the answer is that they both could be right, depending on the potential

gain of a given transaction and the probability that these gains would be

realized.

For

example, you might think that precious metals are going to appreciate at least

for a couple of years (which is the case in our view), as there is a host of

fundamental factors that give you that certainty. You can therefore invest much

of your capital in silver and gold and wait for them to become more expensive.

The upside is big, but not as enormous as in the short term transactions

(annualized). Risk is limited as the whole transaction is based on logic and

fundamental analysis. Simple, yet effective.

Short-term

speculators usually do not care about fundamentals of particular market - they

use technical analysis, daily news and more often level 2 quotes. The upside

potential (let's say it's short term options) is usually several hundred

percent in a few days or weeks, but the risk is also much greater than compared

to long term investing. If you want to make money in this way, you need to keep

the size of your position rather small. You might ask: "How small?" We

will answer this question shortly.

The next

question you might ask is, if and how can we make use of both strategies to

boost our profits while keeping risk at the low level?

The answer

is yes, we can. From a short-term trader perspective, we can use most of our

cash reserves to purchase assets that have a very low risk on them. Long-term

oriented investors can use several percent of their capital to speculate in the

short-term. Results are the same, meaning that we get a portfolio of both short

and long term oriented securities. Thanks to this approach, even if we are

wrong on the short-term, we will still most likely profit on the whole

transaction. Being wrong in the long term will probably not mean losing all

capital employed in that transaction and possible losses are likely to be covered

by profit from the short term transactions. Both speculation and investing are

time-consuming activities but profits you gain are usually well worth the

effort.

The final

question is how do we choose the appropriate size of the short and long-term

securities. The answer is a bit complicated, please bear with us, as we

explain.

Usually,

most questions can be answered through experiments, however in the investment

business learning on one's mistakes can be a costly and difficult task. One

reason is that often outcome of a particular action is known after days, months

or even years. If, as a kid, you played ball in your house, broke a vase or

mirror, and got somehow punished, you probably understood that you really

should not have done it. However, if you

played ball in your house, hit a vase, but it fell

and broke 6 months later, odds are you would not associate it with the

ball and would not learn your lesson. Unfortunately, investing is often the

latter type of relation. Success of a given transaction is also result of many

factors, including random ones. It is extremely difficult to know which factor

was responsible for a particular reaction. Was this decision right and this is

why this transaction is successful or maybe this transaction is successful

because of some random every-day noise, DESPITE the wrong decision?

It's

impossible to tell if you make just one transaction - you have to make a lot of

them to test particular transaction. Other factors are likely to differ between

transactions, so you may decide that it is better to make some kind of

simulation of transactions instead of watching the real ones. It is possible

and efficient if you can approximate the probabilities of outcomes. You could

then "clone" a particular transaction and check what would happen to

one's capital if he/she re-invested it using the same strategy each time. Thanks

to this you could see what is the long term effect of this particular APPROACH.

This is very important, since if you know that your approach is prudent and

justified, then you will not get frightened if you occasionally lose a small

part of your capital. Without that knowledge you could easily get discouraged

to from a particular trade, which would most likely prove very profitable in

the long run.

This methodology

is even justified from a philosophical point of view. German philosopher

Immanuel Kant stated that you should ‘act that your principle of action might

safely be made a law for the whole world’. As investors we may adapt this

thought by making sure that our decisions are optimal in the long term. That

means ensuring that if a given transaction is repeated over and over again and

we make the same decision every time, we would gain most.

For example,

let's say that you have a 70% chance that you gain 100% on your capital and 30%

that you lose everything. Expected value of this transaction (you can easily

imagine, that this is a purchase of a short term options which you expect to

double) is 70% * 200% + 30% * 0% = 140%.

Clearly it

seems to be profitable. How much capital would you deploy to this scenario? Let's

say that you have about $10,000 and decide to deploy everything.

Chance of

winning is 70% so on average, 7 out of 10 transactions will be winning ones and

3 will be losing ones.

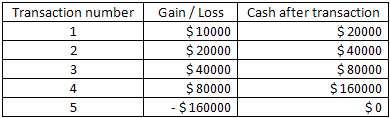

Table below presents likely outcome of using all of your capital each time.

As you see,

the long term (here: ten transaction) outcome of this decision is losing all

your money.

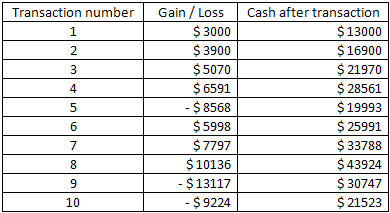

Now, let's say that you use about 30% of your money.

Although

the first strategy gave you amazing $160,000 temporary, you end up with

nothing. Second, more conservative approach, gave you total gain of about 115%,

which is almost 8% per one transaction.

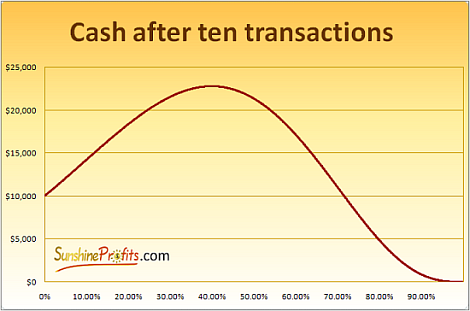

Please take a look at the following graph – it shows the relation between the amount of money (percentage-wise) you decided to invest in this simple scenario and the amount of money you would have gained after ten transaction (of which 7 would be winning ones).

Actually,

the optimal size of your position is 40%. That would give you total gain

of $12,769.32 which is about 8.6% per transaction. This is just a hypothetical

scenario, but in reality you could put almost all cash from the part that you

don’t use for speculation and put it into sound, long term investment. This

could be stocks of senior gold/silver companies, a basket of juniors or the

precious metals themselves.

On the

other hand, if you are a long-term investor, you could boost your overall rate

of return by putting only a small part of your holdings into more risky strategies.

Naturally, we assume that these strategies are more profitable than the long

term investment. Here’s an example:

The risky

strategy is buying short (1 month to expiry date) term call options on gold or

seniors gold companies and you assume that they have 33% chance of gaining 500%.

We took a rather extreme example to better show you that even such transactions

can be used, if the size of your position is appropriate. You decide that your

maximum share of capital you will ever decide to use for short term trades is

30%. In this case, the long-term-optimal position size is about 16%. 16% of the

30% of your capital used for short term trades is merely 4.8% of your total

capital. The average rate of return from this transaction would most likely

amount to 2.5% - in terms of your total capital per month since we are writing

about short term options. This means almost 35% of annualized gain. The 4.8% is

the critical amount, so it still makes sense to use even 2% of your capital for

this transaction, if the risk still seems to be too big for you. This approach

would still give you about 15% annually. The point is that your long-term

investment would not be greatly influenced but this strategy – after all 98% of

your capital would not be used for it. That doesn’t look that risky after all,

does it?

Important

lesson that you can learn from this simple scenario is that at some point

risking more capital does NOT give you more profit. That means that no matter

how risk-tolerant and brave you are, there is a point when it makes no sense to

increase your risk exposure, as it would decrease your profit in the long term.

Applying

this methodology tells you exactly how and why long term investors and short

term traders can be successful over time. For rather safe (95% chance of

winning), long term transactions, which let you gain about 50% of your capital,

this model would suggest using over 90% of your capital dedicated to this sector

(precious metals in this case). This is exactly what most of long term

investors do – keeping some powder dry, but investing a large part of their

capital. Short term investors would most likely stick to risky strategies, as

the one mentioned in the previous paragraph. This time it is prudent to invest

only a small part of your holdings in each transaction.

Another

thing is that you should think long-term even from a one-trade perspective. Combining

single long-term-oriented transactions will give you a long-term-effective

strategy. When entering a single trade you need to be comfortable with the

amount of capital left after the money put into this particular trade is lost.

This principle has already been found and successfully used throughout history.

The legendary French ruler, Napoleon Bonaparte perfectly understood that you

need to know your risks and take them into consideration before you get

involved in particular action. "I accept I might be defeated, but caught

in surprise, never" is one of his famous quotes. When we apply this phrase

to investing, we must realize that we may lose a particular trade, but we have

to be prepared for it.

If you want

to know exactly how much money that should be, you need to use some tools to

help you with that. You can easily make similar calculations, for example,

using your worksheet program. Calculations for different time-frames are more

sophisticated than those presented above. Whatever method of calculating the

positions you use, you need to keep in mind the long-term effects of this

particular strategy. As shown in the above example, you can have a profitable

strategy from a 'one-trade' perspective, but if you repeat it and you invest

too much money into a risky security you may end up losing money.

We have developed the Position Size Calculator, which gives special attention to long term success of your portfolio. It is designed to optimize a strategy between short, medium and long term options, however you can also use it to calculate positions in the short-term only – for example such as presented above. sign up today for a free trial of the Premium Service and you’ll gain access to all our Tools and much more. Naturally, you may Subscribe right away. We use the methodology described in this essay as well as many other techniques to forecast market’s moves and discover unique opportunities for profit. When you register, we will send you occasional, brief market alerts, based on our research, whenever situation requires it. Registration is FREE of charge and you may unregister anytime.

![[Most Recent Charts from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_4.gif)

![[Most Recent Copper from www.kitco.com]](/files/idx24_copper.gif)

![[Most Recent XAU from www.kitco.com]](/files/idx24_xau_en_2.gif)

![[Most Recent HUI from www.kitco.com]](/files/idx24_hui_en_2.gif)