Does you silver stock truly shine? Part 2: The Silver Stocks

By this metaphor we

mean the stocks that truly are worthy being called the THE SILVER STOCKS. It's

not that these companies are better managed than other (however that might be

the case) or that they have more appealing P/E ratio than other stocks. The

point is that some stocks offer you more exposure to the price of the white metal,

than others. In this way some silver stocks might indeed be shining more than

other silver securities.

As you may see in the title, this is the second

part of the article. If you are familiar with the first part in which we

analyzed gold stocks’ exposure and leverage to gold, we suggest you briefly run

over topics already covered and focus on the parts dedicated especially to silver

stocks. If this is your first contact with our essays devoted to measuring

exposure and leverage then we advise you read all paragraphs before

interpreting the results of our analysis.

Most of the stocks analyzed below are

components of the GDX EFT. In fact out of covered silver stocks, only

Silvercorp Metals Inc. is not included in this fund.

Exposure

OK, in order to find out how much exposure to

the price of gold or silver a particular stock has to offer and to compare it

with other companies, we need to choose a way of measuring this exposure. One

way to do it is to dig into company's profile, balance sheet, profit and loss

statement, cash flow statement and other documents and try to establish how

high fixed and variable costs are involved, company's policy, environmental

laws and so on and so forth.

Sometimes, after you would go through all that

papers the situation would change dramatically and/or the market would not

agree with you and value the stock differently for a long time. This is one of

the reasons that we will not use these methods in this essay. Instead we will

adapt a different approach. Let's see what the market thinks about particular

stock. If that's true that all information are discounted in the price then

perhaps we can infer the information we need straight from the price itself. We

can do it by doing some statistical calculations on the prices the market gives

us. We decided that the best measure here would be the R-square coefficient.

From definition (source: Wikipedia): R-square

is the coefficient of determination. It is the proportion of variability in a

data set that is accounted for by a statistical model. In this case R-square

tells us how much of particular stock's price is explained by the price of gold

or silver. In other words how much of the stock is exposed to gold or silver and

how much to other factors. Generally, you probably want to invest in a company,

whose price depends mainly on the price of silver or gold, not on any other

thing. You want a company that uses its resources to produce a profit from its

precious metals operations, not from other activities. Of course it makes sense

for some companies to seek alternative profit sources - for example there are

times, when some of the America's biggest car producers would not be making a

profit if it weren't for their financial operations... BUT After all, you

wanted a GOLD/SILVER stock, right? The closer R-square gets to 100%, the more

exposure to gold/silver a particular company has.

Before we proceed with our analysis of the R-square coefficient, we have to digress a bit.

You have to be very careful when applying

statistical tools and measures to finance. Sometimes the assumptions used don’t

correspond to financial reality. Even if they do or the error you would have

made by using them is really insignificant, you can’t be sure that the model

gives you what you are looking for. It is common that the author of a

particular publication makes the calculations basing on some data, that is not

really relevant, or the reasoning behind choosing a particular model is not

explained to the reader. Not only is

this confusing to the reader as it is more difficult to understand a particular

topic if one does not know what author’s assumptions were, but it can also be

misleading. For example reader might not be aware (Why would he/she? Not everyone

needs to be on the cutting edge of statistics or mathematics) of the fact that

there were actually many models to choose from. Choosing similar (but

different) set of input data could lead to dramatic change in the results and

therefore greatly influence their interpretation.

This article will feature some statistical

measures and their basic transformations. We will try to explain our

methodology as clear as possible in order to avoid any misunderstandings.

Should you have any questions, you can reach us via the Contact Section on our

website at www.sunshineprofits.com

Before presenting the results of our calculations we

would like to tell you a little more about the way we constructed our models. Having

a chart or graph in front of one’s eyes always helps in understanding a

particular topic, as you can directly see what the topic is all about. In the following

part of this essay we will give you a brief introduction to the way R-square

coefficient is generally used and provide you with our reasoning behind our

methodology.

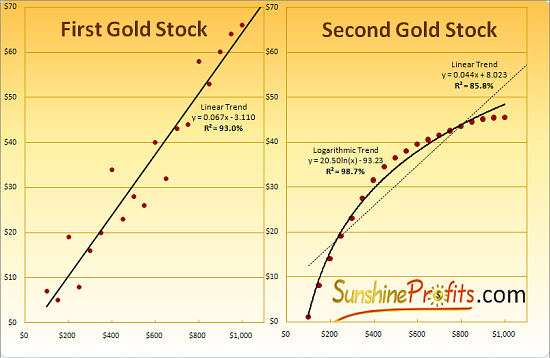

First let us show you how tricky it can be to

focus just on pure numbers. We have already stated that R-square tells you

which stock is explained to the greater extent by the price of gold or silver, so you

should not have any trouble playing a little game with these coefficients. Please

take a look at the charts below. They both represent the relations between two

theoretical gold stocks and the price of gold. We have calculated the trend

lines for linear models for both stocks (on the Second Gold Stock it’s the

thin, dotted line) and respective R-square values. Without looking at the

answer right now, try to answer the following question:

Which of these two precious metals stocks is

better explained by the price of gold?

So? What is the correct answer?

If you’ve pointed the Second Gold Stock as the

one that has been better explained by the price of gold, then congratulations,

you were right. The R-square value is higher in case of stock A only, if we

look only at the linear relations. If we allow ourselves to calculate this

coefficient for different models it becomes clear that the amount of “noise” on

the chart with Second Gold Stock is smaller than in case of the first company.

It’s not linear but... Who said the relation between gold/silver and gold/silver

stocks should be linear?! It does not have to be linear. Company’s profit does

not relate so directly to the price of metal itself. It could not, as so many

factors are involved. Both variable and fixed costs differ from company do

company, marketing strategies give different results, management has different

pay schemes and so on. Those were only the differences in profits. Now take

into account different dilution of shares and you get the idea why not always

the assumption of linearity needs to be fulfilled.

Since R-square can be calculated for various

models, we will present you with our results of calculating these coefficients

for best models. Before choosing your favorite gold/silver stocks and putting

your money on the table please note that using R-squares obtained from

different models may be sometimes misleading. R-square as such does tell you

how well this particular model reflects used data. Higher R-square values may

not always mean exactly that a particular gold/silver stock is more influenced

by price of gold/silver (as it was in the case of presented theoretical gold

stocks). If stock A has higher R-square than stock B, it may also mean that

the model applied to stock A suits it better, than the model applied to stock B

suited stock B. Keeping that in mind you need to be careful when comparing

similar values of this coefficient. The table that we will present in this

essay was created using different models – for each stock we chose the best

trend line and calculated R-square for this particular model. R-squares’

comparability is therefore limited. We take the view that you can compare

stocks only if the difference between coefficients is not minor. For example we

would not differentiate between stocks that have R – squares of 71% and 73%,

but we certainly would if they equaled 30% and 80%.

Having said that let’s get to the merit of this

article – we’ll going to tell you which stocks are most influenced by price of silver

– in other words those that give you the biggest bang for the buck.

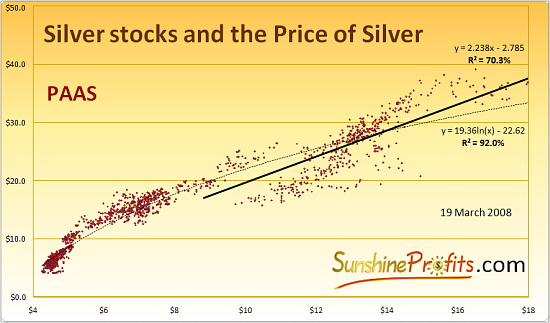

Below you will find chart which shows the relation between the price of silver and one of the well known silver stocks – Pan American Silver Corporation (PAAS). Please take a moment to study the chart before you continue reading.

As you may see, the chart covers the data for

both silver and PAAS back to the beginning of this bull market, when gold

traded below $300, silver was well below $5 and neither of them was a very popular

investment to say the least. Basing on the price of silver and respective PAAS’

share price, we calculated and attached the trend lines which best represents

the relation between both variables. Not all of this data is used for each

trend line, as you may see on the chart, but we’ll get back to this later in

this essay. Right now we would like you to focus on the shape of the trend

lines. Please note that the dotted, thin line rises fast at lower silver prices,

but the pace of growth declines along with rising silver prices. These are

exactly the properties of the logarithmic trend line. We’ve taken into account

several types of trend lines and found that this one is best to represent the

data that goes back to January 2002. We’ve chosen this date as it represents

the moment when both gold and the HUI index broke out of their long-term

downtrends. One may argue whether time between 2000 and 2002 was still bear

market or was it already bull market, but most people (of course except for the

gold perma-bears, who will still deny the bull’s existence) agree that in 2002

we either began or already were in the first stage of the bull market in

precious metals. So, the share price of PAAS for the entire bull market can be

best described using the logarithmic model. We can say that, because we’ve

checked R-square values on the same data for different models. We’ve chosen

from linear, logarithmic, power and exponential trend lines. All other models gave R-square values lower

than the logarithmic one. R-square of

92.0% means that in this model price of silver accounted for 92.0% of the PAAS’

prices’ move. This is a very good result in the long term – if you’re

looking for stocks with direct exposure to silver, PAAS is sure worthy to be

put into your portfolio.

In the search for a coefficient that might better

match current time, we separately calculated trend lines and R-square for shorter

term – for the second stage of this bull market.

In the second stage new groups of investors

enter the market. In this case that would be financial institutions recognizing

the presence of the bull, as well as foreign investors, who see precious metals

appreciate in their local currencies. Since we have different investors, we

might infer that the average way of perceiving risk and leverage associated

with mining stocks will also change accordingly. In our view, we are still in

the early part of this phase, so it makes sense to develop unique tools and

make specific predictions with this stage in mind. This is why our research towards

estimating particular gold / silver stocks’ exposure and leverage to precious

metals will focus on this time frame.

For this, more detailed analysis we will use

the data that goes back to the beginning of 2006. That was the time, when gold

broke out of its trading range in Euro and stayed above previous resistance

long enough to attract new capital. One might argue whether this is precise

time when the second stage of this bull market began (some prefer to think of

the breakout date as the exact beginning) or not, but choosing this date has

also additional advantage to our analysis.

Beginning of 2006 is also the moment when

prices of precious metals reached important levels: $550 for gold and $10 for

silver. Once these milestone were achieved, the price accelerated and peaked a

few months later. Since then we have endured a long consolidation phase, during

which these important milestones have been tested and verified as new

super-strong resistance levels. That gives us reasoning for making the assumption

that we will not see these levels breached to the downside in the near future -

by that we mean at least the second phase of this bull market. Of course

everything is possible in these volatile markets, but some events such as this

one are very unlikely.

The bold line on the above chart of PAAS

represents the trend line, which is based on the data exclusively from the second stage of the bull market. This time the trend line is linear and the R-square

value equals 57,9%. It seems that the company lost some of its exposure to

the price of silver, or at least markets perception toward this exposure

changed considerably. Nonetheless the true implications of this value will emerge as we compare it with

results for other silver stocks.

We already know what information we might infer

from the value of R-square coefficient, now we have to be sure that we know

what this coefficient does not tell us.

R-square does NOT tell you how much leverage

to silver does a particular silver stock have. It informs you exactly what

percent of past observations (stock prices) have been explained by the price of

silver in particular model and that's it.

Leverage

If you want to know the real leverage you need

to find out exactly how much percentage-wise (theoretically) should a

particular (gold or silver) stock move if the price of the underlying asset

(gold or silver) had risen by 1%. Choosing simply the coefficient that decides

of the slope of the trend line (2.238 for the second stage in PAAS’ case) as the measure of the

leverage can be misleading. That means that for every dollar rise in the price

of silver, price of PAAS will increase on average by $2.24. Unfortunately that

is not comparable to coefficients of other stocks, as the nominal prices of

stocks are different.

For example if you have stock A that trades at

$100 with slope coefficient of 0.5 and stock B that trades at $1 with slope

coefficient of 0.1, which one of them has higher leverage to the price of gold?

Remember the slope coefficient tells you how much will the stock gain in dollar

terms if the underlying metal rises by one dollar. The answer is stock B. That

is the case, since when gold rises 1$ the price of A rises by 50 cents which is

0.5%, while the stock B would rise 10 cents which is 10% of the stock value. If

you want to be leveraged, which stock would you prefer - the one that moves by

half percent with every dollar move on the price of gold or the one which moves

twenty times more - by 10% percent?

Of course the answer is: Stock B.

Therefore we have transformed the slope

coefficient of PAAS’ trend line so that it can be comparable to coefficients

from other stocks. The result is about

1.08%. Please note the word “about” – we cannot say accurately, because is

the selected (linear) trend line, the leverage is constant in dollar terms, but

if we take into account the share price and the price of silver, we get the

Beta, which takes diverse values for different silver prices. In fact, only the

leverage calculated for power trend lines is constant in percentage terms. In the

case of PAAS, the Beta would be 1.09% with silver at $15 and 1.07% with silver

at $20. As you see, the difference is not that big. Calculating leverage for a

specific silver price is not much of a disadvantage, since non-linear models

have different slope coefficients for different prices of metal, so the

distinction between different prices and following different betas would have

to be made anyway.

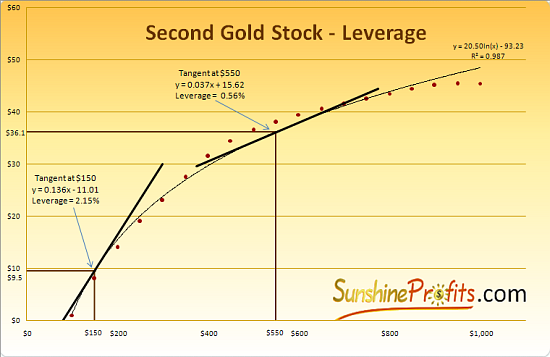

Astute reader might ask about the slope coefficient, as for example logarithmic function does not have one defined slope. This is why we take the slope at exact price of silver. For one, precise point we might calculate the slope coefficient for the tangent of the trend line. Please take look at the following chart – we used the same theoretical data as in earlier example:

Please note how the leverage changes along with

the slope of the tangent, which of course changes along with the price of

underlying metal (gold in this case, and silver for PAAS). Although the price

of the Second Stock is very well explained by the price of gold (R – square =

98,7% ), the leverage that the company has to offer is very discouraging at

higher gold prices. With gold at $550 the price of this stock will rise on

average by about half percent, when gold moves one percent. One could even say

in a sarcastic tone, that it is the gold that has leverage to this stock, as it

outperforms it without the inherent risk that the stocks carry.

What are the implications of this all this for

silver stock investors and speculators? First consequence is quite obvious –

you need to know the time frame for which you want to invest or speculate. In

the above example if the price of gold were at $100 and you would want to bet

your money on the move to the $200, then this stock would be great. On the

other hand, if current gold price were $800 and your strategy was to hold this

stock until gold reaches $1000 then you should probably consider other options.

Our research shows that when it comes to silver

and silver stocks during the second phase of the bull market, almost all of

them are best characterized by the power trend lines. Like we stated earlier,

power trend lines mean that the stock’s leverage to metal (silver) does not

change percentage-wise. Since that is the case, those of you who want to see

the results are free to scroll down to the tables with R-squares and

leverages, as it can be interpreted without additional information. However if

you wish to know what you can do to compare stocks with different trend lines and uneven

leverage then you should find the next couple of paragraphs quite interesting.

Here’s how you can deal with these conditions

for different strategies:

For short term trades (for example for 60 cents

move on the price of silver that you expect to take place within next couple of

weeks) you will not make a big mistake by choosing stocks basing on their current

betas.

For medium term transactions you may also stick

to current betas, as long as you make sure that the leverage will not change

dramatically during your the time you want to hold your position. The table in

the later part of this essay might prove helpful in this approach.

If you plan to hold your stocks for some time

(and take advantage of large upleg in silver) good idea might be to take into

account the leverage for the average price of the metal (for PAAS it is

naturally silver). So, if you expect the price to go from $15 to $20 you might

want to check first the leverage for both $15 and $20 and then the leverage for

the average price – $17.5 in this case. Small difference between the beginning

and end values (1.09% and 1.07%) tell you that the leverage is pretty stable in

this price range and that you really don’t need to make any adjustments –

results are informative enough. The beta for 17.5 is actually 1.08%. That gives

you the idea, how the stock might act in response to the price of silver at

different price levels. Here the distinction is not very big, but there are stocks

when the difference is sizeable.

If there is a huge difference between leverages

for a particular stock, you should calculate them manually. That means putting

the initial and final price of silver for your transaction into the equation of

appropriate trend line. Then you have to see how much percentage-wise your

stock would rise and compare it with other stocks for the same rise in the

price of silver. The one which rises most percentage-wise is obviously most

leveraged. You can do these calculations roughly reading the values from the

charts (not precise), you may find in the full version of this article (comming soon) or you

can use the Tools section (which we recommend) on our website to get silver

stock prices for any silver price.

Without having proper

(sometimes non-linear) trend lines and without realizing that the leverage

usually changes along with the price, your chance for choosing optimal stocks

for your portfolio is limited.

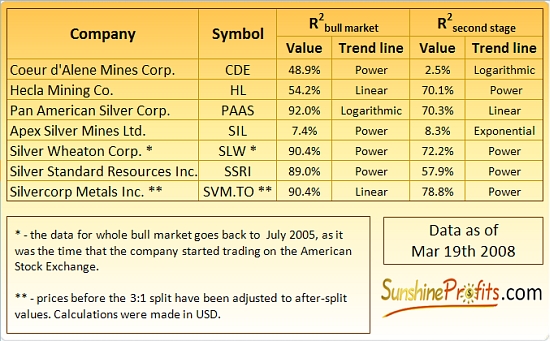

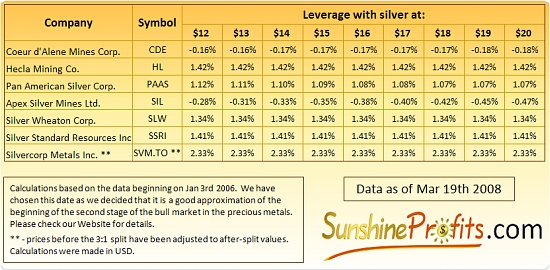

OK, we know what R-square means and what it does not mean. We know how we might estimate silver stocks’ leverage for different durations of transactions. Like we said earlier in this essay, we will now provide you with R-square values and leverages at several prices of silver. Please see the tables below:

It should not come as a surprise that almost all of the popular silver stocks show

direct relation to the price of silver in the long term. What is really

interesting is the very weak correlation between SIL and the price of the

underlying metal. Most likely this is connected with hedging, but we won't go into details here. Through these numbers markets say (at least we read it as

such) that although SIL does have a history and name connected with silver, it

does not act like a silver stock at all. In our view this situation may change

in the future, but for now, our analysis suggests using other stocks if exposure

to silver is what you want. Coeur has only a fairly strong

exposure to silver in the long term, but in the second stage their R-square

value is far from similar. In the period from Jan 2006 Coeur's has not

performed very well with regard to the price of silver. In fact the R-square value for this company decreased dramatically to 5.4%. Not only does the

company trade rather independently of the

price of silver but it's also declining along with rising metal prices (please

note the negative leverage below). Other analyzed stocks have at least sufficient R-square about or

above the 60% level, for the second stage of the bull market. These equities are recognized by the market as the true

silver stocks.

Before we proceed with presenting the table with betas, please note that during the second stage of the bull market almost all of the silver stocks are best represented by power trend lines – only CDE, PAAS and SIL are suited best by a different trend lines. That means that for most stocks leverage is constant in percentage terms regardless of the silver price. PAAS’ leverage declines but the amounts by which it decreases with every dollar move in the silver is really modest and does not seem to affect stock’s overall appearance. For detailed information about silver stocks’ leverage please see the table below:

The leverage coefficients tell you how much

percentage-wise you will gain when the underlying metal rises by 1% and the R-square tells you what part of this rise may be attributed to the rise in the

price of the metal. All featured leverage values (betas) are standardized for

1% move in the price of silver.

As you may see on the above chart, the leverage

for most of the stocks is above 1%, meaning that you get some extra profits by

using these stocks as a proxy for silver instead investing in the metal itself.

In fact only two stocks do not fall into this category: CDE and SIL. That’s not

surprising as these stocks don’t seem to have almost any exposure to the price

of silver – at least that is what our statistical analysis shows. Since they

move rather independently of the metal price it’s no wonder, they don’t have

any leverage to it.

The leverage for HL with regard to silver

should be a little lower than that presented in the table above due to

company’s exposure to gold, perhaps around 1.2% - 1.3% level. More on this

topic in the full version of this essay (check our Website in several days for more details).

Before you choose your favorite silver stocks

and make a purchase or add to your positions we strongly encourage you to make

additional analysis covering fundamental and technical aspects of these

companies. Also please remember that it’s not a bad idea to diversify your

holdings, meaning that it’s prudent to hold more than just one silver stock.

Although we strongly believe that the

statistical measures used in this essay are very helpful tool in choosing

stocks for one’s portfolio and we use it ourselves, we must inform you about

possible risks involved in using statistics for making your trading decisions. Not

all assumption made in statistical models are necessarily fulfilled in the

capital markets.

If we used statistical tools directly to

trading we would have to be sure that these unrealistic assumptions will not

make us lose our money. They are of lesser meaning if we use this data to

compare stocks between themselves. Even if each calculated coefficient is

biased as a result of assuming normal distribution of returns, it does not pose

a serious threat as long as you only use the results for comparison. If all

results were biased from the same reason, most likely the relations between

them would not be affected.

This is the shorter version of the essay. If

you want to read the full version (containing charts with trend lines for all

popular silver stocks including: CDE, HL, SIL, SLW, SSRI and SVM.TO) please

visit our Website in several days

and browse the Research section.

Want to know exactly how much will a particular

stock have leverage at given silver or gold price? We designed a model that

will provide you with that information. Visit our Tools section on www.sunshineprofits.com for details.

![[Most Recent Charts from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_4.gif)

![[Most Recent Copper from www.kitco.com]](/files/idx24_copper.gif)

![[Most Recent XAU from www.kitco.com]](/files/idx24_xau_en_2.gif)

![[Most Recent HUI from www.kitco.com]](/files/idx24_hui_en_2.gif)