Gold and Crude Oil Give Important Signals to Gold Stock Investors

In today’s economy crude oil is one of the most important commodities and energy sources. It is vital for businesses and for individual consumers. Choosing just one of oil’s multiple uses – it is the basic product, from which fuels are derived. Most of us need to drive and purchase goods that also need to be transported to us directly or indirectly. Since oil is so important, it should not surprise anyone that it influences many markets. In this essay I will focus on crude oil’s meaning to gold and silver investors.

In the summary of the essay entitled "Gold and Crude Oil. Should You Be Afraid?" (posted in July 2008) I wrote the following:

(...) gold’s recent price action relative to oil or lack thereof, is nothing extraordinary. In fact, history shows that there were cases of more dramatic underperformance, followed by more fair valuation, even leading to overvaluation – taking into account the trend equation as seen on the charts above. Therefore, in our view, there is no need to panic because of the recent performance of gold relative to crude oil.

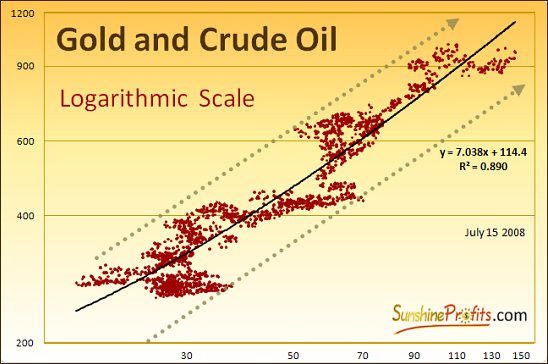

This is one of the charts (data: 2000-2008) that were used to illustrate the relation between gold and oil:

The purpose of the essay was to emphasize the fact that gold and oil undergo the process of relative over- and undervaluation. This phenomenon would be even more visible if one took a larger time-frame into account. In July 2008 prices of crude oil got very high and many precious metals investors were bothered by the fact that gold and silver have not followed crude oil’s steps very closely.

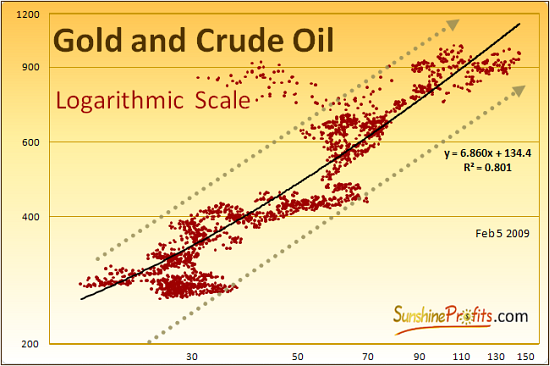

It was only several months ago, when gold was rather undervalued to oil, and now the tables have turned. If one would put today’s gold/oil price combination on the above chart, they would get a point which is way above the trend channel. I updated the data so that it reflects also recent price combinations – please take a look at the following chart:

Today’s price combination is indeed way above the trend line, which is an unprecedented event during this bull market. However, most of us will agree that these are not ordinary times. Currently most commodities (except gold of course) are reacting to the deflation scare that is being hyped by the media. I’m not saying that this is done on purpose so that the powers that be could get away with printing more and more money, but that is definitely a food for thought.

It is important to realize that (contrary to what is often believed) there is also another way to define inflation/deflation, besides “rising/falling prices”. In fact, deflation/inflation are the decrease/increase in the prices of goods caused by the changes in the money supply. If you take this definition into account, we are definitely in the inflationary period, as the amounts of money that were created out of thin air recently are enormous.

I prefer to use the latter definition, as it is confirmed by statistics, history, and basic economic laws. Statistics show that there is a very high correlation between rising prices and the money supply, which is caused by very basic law of supply and demand. Supply of money increases so its price/value decreases - and since the currency's value is lower, then goods price in it will seem to cost more in the long term.

The deflationary scare will not last forever, as ultimately people will wake up to the fact that prices on average are going up, not down. It will most likely take some time, and in the following part of the essay I would like to focus on the way investors can take advantage of it.

As mentioned in the first paragraph, crude oil has many uses, but since transport is very crude-oil-dependent, high crude oil prices mean high costs for all companies. Even if a company doesn’t transport anything directly it will suffer from higher cost of paper, tools etc., as wood, steel, etc. that were used to produce it, had to be transported several times, before the final product was sold. Mining companies are not an exception here.

Higher crude oil prices mean higher costs for mining companies. Higher costs translate into lower profits. Lower profits ultimately lead to lower stock values. Naturally, the same works also the other way around. Of course there are things like oil reserves and so on, but that fact does not invalidate the whole mechanism. It makes precious metals stocks react only to long-term changes of crude oil’s price. On the other hand gold is the general proxy for gold stock’s revenues. Since the HUI Index consists of gold stocks that do not hedge their gold production beyond 1.5 years, it is obvious that the price of gold has a direct influence on these companies’ earnings and thus share prices.

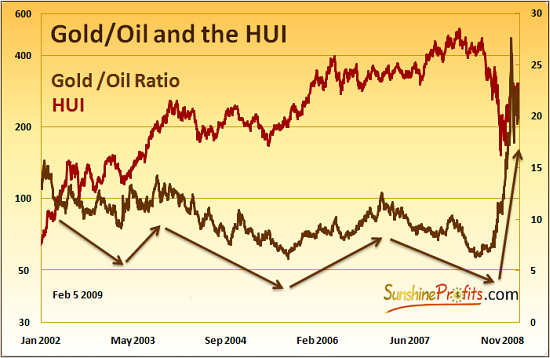

Based on the information from the previous paragraph, one might infer that the Gold / Oil ratio should trade rather in tune with the HUI Index. After all, both: higher gold prices and lower crude oil prices mean higher Gold / Oil ratio. Please take a look at the chart for details.

At the first sight, the above chart might be perplexing, as the HUI Index has been rising rather consequently (that is until the recent carnage), while the Gold / Oil ratio has been declining (until recently). However, if one takes into account the changes in the direction of both lines, ratio’s influence becomes visible. From the long-term perspective one can see that gold stocks were rising, consolidating, rising, consolidating, and so on. What is interesting here is that the consolidation in the gold stock sector took place when the Gold / Oil ratio was declining. Conversely, during Gold / Oil Ratio upswings, HUI rallied.

If that pattern is to repeat in the future, one might expect gold stocks to soar in the not too distant future. Of course, this is not guaranteed that it will happen right away, or that the coming rise in the precious metals stocks will be as sharp and impressive as what we have just seen in the Gold / Oil ratio. The influence that is illustrated on the charts above works in the long term range of a particular move and the HUI Index will not necessarily follow the Gold / Oil ratio immediately. However, should the general tendencies remain in place, we can expect much higher prices of gold and silver stocks in the coming months.

Summing up, we have had much lower prices just several months ago, but that doesn’t mean that a retest of the previous lows is inevitable. On the contrary, the analysis of the two of the most important commodity markets suggests much higher prices of precious metals stocks. This may not happen tomorrow, or the next month, but when the rise does materialize, it should prove worth waiting for.

Of course the market might prove me wrong, as nobody can be right 100% of the time. Should my view on the market situation change substantially, I will send an update to the registered Users along with suggestions on how to take advantage of it. Register today to make sure you won’t miss this free, but valuable information. You’ll also gain access to the Tools section on my website. Registration is free and you may unregister anytime.

P. Radomski

![[Most Recent Charts from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_4.gif)

![[Most Recent Copper from www.kitco.com]](/files/idx24_copper.gif)

![[Most Recent XAU from www.kitco.com]](/files/idx24_xau_en_2.gif)

![[Most Recent HUI from www.kitco.com]](/files/idx24_hui_en_2.gif)