Predicting and Taking Advantage of Corrections in Gold

Are you a gold / silver investor or perhaps

only a gold / silver speculator? Do you trade short term swings or buy and hold

for the long term? Given that you’re risk tolerant

you've probably already had some experience with derivatives on precious

metals (and respective stocks) and are well aware of the opportunities options

give you. If you’re sure you already know everything about using options to

make the most of the big surges and sell-offs, then you surely don’t need to

read this essay. If, on the contrary, you are interested in the subject, but

you believe that your skills could always be improved by reading about new

ideas regarding speculation (we fall into this category ourselves), this essay should

prove valuable to you. Finally, even if you loathe speculation, then perhaps reading this essay would be

interesting to see if our methodology and general conception doesn’t make you

change your mind a bit.

In this essay we will

focus on buying call options when market seems to have bottomed and buying put

options when market approaches top. Taking into account recent top around the

famous $1000 level, we will focus on what could have been achieved if one

bought put options around the top (as a matter of fact, we did). First, we’ll tell you what do we assume about the

precious metals market, then we’ll get to theory and practice behind options, and, finally we will show you how

combining the abovementioned can boost your long-term rate of return.

The precious metals market can be very tricky at

times. We’ve seen many cases when gold and

silver were stuck in a trading range for a couple of months. We’ve seen

situations when both precious metals surged for a couple of months and ended

uplegs with a spike top. Finally, we’ve witnessed situations when gold stopped

rising despite US Dollar’s fall and there were also moments when gold stocks

did not make new highs, as gold itself did.

The latter type of situations will be

especially interesting as we go further. Let’s say (theoretically - just for

the sake of this essay, as the fundamental situation is way more complicated)

that the main factor that decides where the price of gold will go is the value

of the US Dollar Index. The undeniable reason is that gold is priced in the USD

and, therefore, virtually has to respond to

its up- or downswings, by moving in the opposite direction. If the value of

gold was perceived as constant by the investors from all over the world and the

value of the currency in which it is priced, falls, then in order for the price

of gold in their respective national currencies to be

stable, it has to rise in terms of US Dollars. If the price of gold did

not rise as the US Dollar falls, then foreign

investors would see price of gold fall in their national currencies. Unless

foreign investors changed their mind about the value of gold, they would start

buying gold, as it now is cheaper for them than it was when they thought the

price reflected gold’s value. As they would purchase, the price of gold in all

currencies would go up (including USD). For people who make transaction in the

US Dollar it would seem as if the price of gold as just went up out of the

blue, when in fact it would be their Dollars that lost value, while gold’s

‘real’ price was not affected.

Like we stated earlier, there’s more to this

correlation between USD and price of precious metals than just what we

mentioned above, but it’s enough to make a few key points in this essay. As

indicated earlier, there are times when gold stops rallying when dollar keeps

falling. How could this be possible, especially, taking

into account the mechanism from the last paragraph? Ultimately (at least in

most cases), price is settled at the market when

people willing to buy trade with people who want to sell. Please note the words

‘willing’ and ‘want’. There could be powerful fundamentals behind one side of

the market, but at times people just don’t act according to fundamentals. The

reality is more complex than logic, fundamental data and mathematical

transformations can express. The decision making process always involves

emotions whether we like it or not. Simple as that, yet very problematical. Naturally,

people make rational decisions in the long run, but what we focus on here are

the temporary situations where market participants are blinded by emotions and

fail to recognize gold or silver’s true value.

Remember the ‘spring theory’ from our previous

essay about juniors? If not, here’s a quote

from this essay as a quick reminder:

‘This sector [juniors] may be metaphorically

compared to the work of a collapsed spring. The fundamentals are one end of the

spring. The other end represents emotions. As the fundamentals (for following

analysis we will assume that the main fundamental factor is the price of gold)

improve, the spring gets more and more collapsed, unless the emotions follow

the price of gold. That is mostly - but not always - the case. If the emotions

are in tune with the price of gold, the spring does not shrink and in fact does

not seem to matter much. However if - for any reason - fear prevails despite

improving fundamentals, the spring gets really tight, ready to blast. Unless

fundamentals deteriorate, once the fear is removed, we would expect juniors to

go ballistic in no time! The longer and the harder this spring gets squeezed,

the bigger move will follow.’

Situation in which gold stops rising as the USD

keeps falling is somewhat similar to the case from the previous article, only

this time one end is represented by gold’s fundamentals (here – USD Index),

while the other end is the overall market perception towards gold and its

willingness to respond to fundamentals with action. As the USD Index plummets,

the spring gets pushed from one side, and as long as investors are able and

willing to instantly adjust to new fundamentals, the other part of the spring

will keep moving at the same pace. Now, the situation gets interesting as all

those who were interested in the market at that given time frame are already

very close to being 100% invested. If everyone is already in, then who’s going

to buy to make the price go even higher? The general public, of course. Yet,

they too run out of the money. Naturally,

there are people who are buying, but some of those who were already in the market

‘sense’ something weird is going on and they

start to sell. The springs explodes, pushing gold prices down. Price gets

lower, more people sell and so on and so forth. Another top has materialized.

What exactly happened before that? USD Index was falling but gold did not rise

anymore. Just as if the foreign investors got fed up with gold and changed

their mind about it’s worth. Perhaps they have. The fundamentals ceased to

influence the market, as emotions (fear and doubt) replaced them.

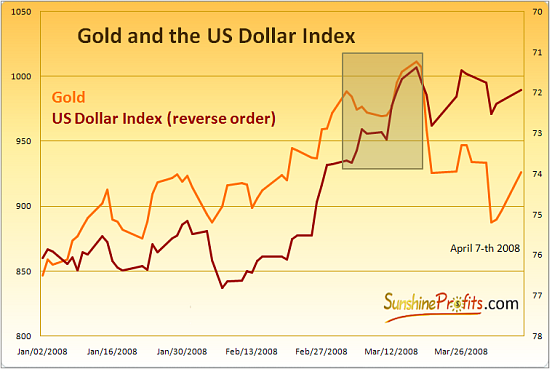

The chart below proves that this analysis really has practical implications. This mechanism worked even better during the May 2006 top, but we decided to show you the most recent price action.

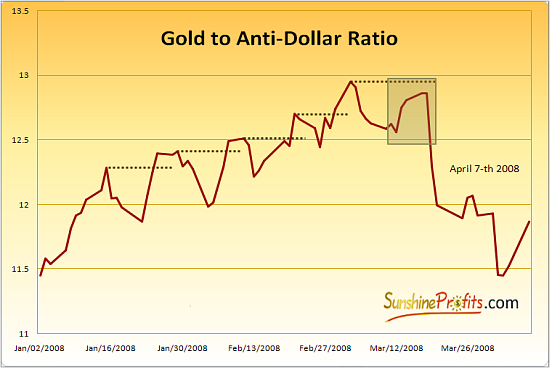

Don’t be confused by rising USD Index – we have reversed the order on its axis, so that you can better see how gold’s reaction toward changes of the USD decreased. The marked rectangle allows you see just how much influence dollar’s final fall had on the yellow metal. Please note that these are closing prices. The increase in the price of gold from March 3-rd to March 17-th did not respond to dollar’s fall during the same time frame with the same magnitude. This is clearly visible on the chart above. If you had a ratio of Gold to the Anti-Dollar index (shaped like USD Index in reverse order), it would surely confirm that this rally is nearing its end. We have created such a ratio and you can see it on the chart below.

The assumption from the last paragraph is

correct. You can see that contrary to all previous tops, the top preceding the

sell-off did not manage to achieve a high higher than the top before it. Seeing

situation like this should make you really suspicious towards the new top. Add

to it the media hype when gold price breached $1000, and you get high

probability that the smart money will sell gold to the general public, which

entered the market after they saw gold ‘in the news’. After that is completed,

the price is very likely to plunge. In our view that is exactly what happened.

Why does it work? It’s always a tough call in

any tool related to the psychology, especially, regarding investment business. We think that by

‘dividing an asset by its main fundamental factor’ we might get quite good

representation of the emotional status of that particular market participants.

This is a very rough estimation, as neither dollar is the only factor behind

the price of gold, nor do we have a very large sample to test this analysis

(taking into account the second stage of this bull market only). However, it

was never supposed to be one and only super-indicator, but rather another tool

that we might use to better understand market’s behavior and profit on it.

The point here is that unlike each investor's

emotional status and approach towards market, we can directly see on the charts

when gold’s price stops rising despite dollar’s fall! Knowing what

psychological mechanism takes place behind this particular price action in the

USD Index and gold, we are able to infer that there is higher probability of a

sell-off than it was prior to it taking place. This works both ways. When gold,

after declining for some time, stops reacting to dollar’s rally, it indicates

that this move is overdone. Obviously, it is not certain that the top will

immediately follow, but the probability

of this happening is considerably higher.

What is even more interesting is that the same

type of analysis can be applied to gold and silver stocks. This time we will

narrow the reasoning behind the swings in the price of particular precious metals

stocks to the metals themselves. Of course this makes sense only for stocks

that have a high exposure to the price of gold or silver (for details see the

Research section on our Website). When precious metals stocks

stop declining despite the falling price of respective metals and seem to

bounce each time you would expect them to fall hard, you may expect that this

sell-off’s days are numbered. Again, this works both ways – if stocks simply

refuse to achieve new highs, as gold rises, it is a strong indication that

stocks are ready for a correction. Still – it is not obvious or certain that it

will happen, but the probability of it happening is higher.

The really powerful combination is when gold

stocks stop reacting to gold rise, and gold starts to ignore dollar’s fall.

Combining these two ‘springs’ gives you a strong suggestion that this rally is

over and one should prepare for the sharp sell-off. How can one do it? Most

popular strategy would be selling all or part of your holdings and waiting for

prices to fall a certain amount of percent, reaching a particular moving

average etc. Here, we would like to present you another possibility and give

particular arguments for it, but before we do, we will tell you more about

options. Those of you who are familiar with and use options, may skip a few

paragraphs.

Basically, option is a derivative that can be

used either to hedge one position’s, or to

speculate on the outcome of a particular situation in the underlying equity,

magnifying gains that can be achieved through purchasing or selling a

particular security short. Each of the above can be made by either writing an

option or by buying it. There are put options,

whose value increases along with falling prices of the underlying security, and

call options which gain value along with the underlying security.

Not always the same move in the underlying

equity means the same gain on options on them, as there are more factors

influencing the price of a particular option than just the price of the

security. Other factors (according to the Black – Scholes Options Pricing

Model) are the strike price, time left to option’s expiration date, the

risk-free interest rate and the volatility. If you want to learn more about

options, calculate options value etc., visit

the Tools section on our Website. For the purpose of this essay we will focus

on the influence that the volatility has on the price of a particular option.

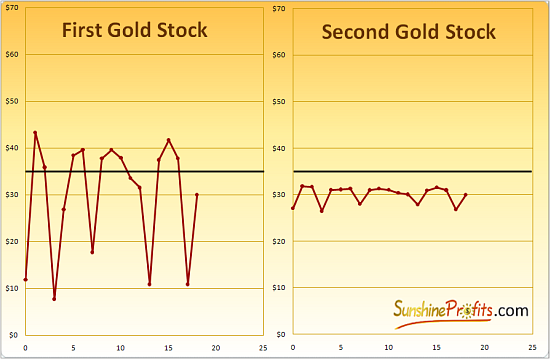

All other things being equal, option’s value tends to rise along with the volatility, and decline when volatility is decreasing. There is a special coefficient called ‘Vega’ (sometimes being referred to as ‘Kappa’ or ‘Tau’), which tells you how much (in dollar terms) will the price of a given option rise, when the implied volatility of the underlying security rises by one percentage point, and nothing else (interest rate, time, price of the underlying security) changes. Although this might seem to be rather complicated, you can see on the chart below that it really is intuitive.

The last price for both stocks is $30, and this

is also the average value of each of the stocks in the analyzed time frame.

Which stock is more likely to surpass the thick, black line at $35? Of course, the First Gold Stock. Since its daily trading

range is so wide, it would be surprising not to see this stock occasionally

getting past the line. The Second Gold Stock, on the other hand, would most

likely need to rise consequently for a few days, before it would have chance to

get beyond marked level. As you see, the probability for the stock price to go

above certain level is higher if the stock is more volatile. Now imagine that

this line represents strike price of a particular option. Not taking into

account the time value (e.g. at the day when particular option expires), the

call option’s value is the difference between the current price of the

underlying security and the strike price. If the chance for the underlying

security to go past the strike price is higher for the First Gold Stock than

for the Second Gold Stock, all other things being equal, than options on the

First Gold Stock should be worth more than options on the Second Gold Stock.

Summing up,

options on stocks that are less volatile are cheaper than those on more

volatile stocks. If a particular company’s shares become suddenly more

volatile, then options on this company will become more expensive. And, if these shares calm down and trade in a

close range, then the value of options will decrease (all other things being

equal).

Now we’re ready to get back to the previous

part of this essay, in which we dealt with precious metals’ tendency to minimize its natural reaction

towards fundamental factors at the end of rallies or sell-offs. We ended this

part with statement that when gold stocks or gold stabilize despite improvement

in the fundamental situation (here: gold and USD Index respectively), then the

chances that the trend reverses, at least

temporarily, are rising. Now put this into

different perspective – what will happen to OPTIONS on these gold stocks or

gold itself, as the price stabilizes, meaning that the volatility decreases?...

Exactly. From a quantitative point of view, the

chances of decline or further rise will be lower, as the volatility declined,

so the options on precious metals and their stocks will be priced lower. That

is precisely contrary to what the previous, psychological analysis would tell

us. Surprised? Remember – as we stated earlier – the reality is more complex

than pure mathematical transformations.

Being able to recognize technical patterns that are influenced by psychological

mechanisms gives you an advantage over the vast majority of market

participants.

How can you use this information? If you spot a

situation like this in the future (which is relatively common in the precious

metals market), you can either short the market with A SMALL PART of your

capital or use it to hedge your positions. You can also sell part and hedge the

rest or use any combination of the above, all depending on your risk

preferences and the time you have to manage your portfolio. Either way you use

this strategy, combining the advantage that the technical (here: psychological)

analysis gives you with understanding how options work, gives you the ability

to massively increase your holdings or substantially decrease losses.

In our view, hedging your portfolio in this way is superior to simply selling your

holdings, since it gives you the opportunity to gain additional profits

thanks to the increase in options’ value after dramatic (volatility rises)

sell-offs. This means risk reduction if you decide to put less capital into

this strategy, as less money is needed to give you the protection similar to

the one you would get without ‘the bet on volatility’. The fact that options

have time value can be seen as an advantage (yes!) here. It’s counterintuitive,

as the time-decay causes options to lose value, but we really think that it may

prove profitable for some investors. The reality is that when people get out of

the market, they sometimes fail to get back in at lower prices, as they start feeling

the same emotions as other market participants. The prevailing emotion after a

sell-off is fear, which prevents people from reinvesting in the shares they

have just sold. After shares start to rally, people wait for a pullback, which either

doesn’t come or even if it does, it doesn’t seem to be deep enough to make them

purchase their favorite PM stocks. Finally people often get back into the

market at prices higher than those at which they sold their shares in the first

place. Since options have a ‘time limit’, it means that you will get back your

exposure to rising gold and silver prices rather sooner than later. Although this

theory is questionable, we view this feature of put options as highly

practical.

Those of you, who believe that ultimately

‘paper gold’ or ‘paper silver’ (meaning anything else than physical bars or

coins in your own possession) will become worthless or at least trade at a

discount to the real, tangible gold and silver, might be interested in this

form of temporary decreasing your exposure to metals. After all, you would keep

your gold and silver in the physical form, safe and sound, ready to protect you

in case of any financial disorder. In case there is no dramatic change in the

financial system, and metals simply plunge temporarily, as was the case in the

past, you would be able to minimize or even prevent losses. From a different

perspective you would temporarily minimize your exposure to particular metal by

being long the physical form of the metal and being short its ‘paper’ form. This

might appeal to you, as it corresponds to the assumption made in the first

sentence of this paragraph.

Usually you can use short-term options, as

sell-offs in the precious metals market are generally rapid. For most cases you

should be fine with options, which expire at least one or two months after your

initial forecast when the low might take place – e.g. options that expire three

months from the moment you decide the top is almost in. Please note that the

less time these options have until expiration, the more profitable this

transaction might be. This means that you can use less capital for hedging your

positions. Whether using more risky instruments but to a smaller extent makes

the whole strategy more or less risky is a different matter, which will be

addressed in our next essay.

Which options exactly? What expiry dates should I use? What strike price? This and more questions will be answered in future essays. Next week we plan to tell you more about choosing optimal size of your position. Meanwhile, we invite you to register today at our Website, which will allow you to access our Tools section and much more. We use the methodology described in this essay as well as many other techniques to forecast market’s moves and discover unique opportunities for profit. When you register, we will send you occasional, brief market alerts, based on our research, whenever situation requires it. Registration is FREE of charge and you may unregister anytime.

![[Most Recent Charts from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_4.gif)

![[Most Recent Copper from www.kitco.com]](/files/idx24_copper.gif)

![[Most Recent XAU from www.kitco.com]](/files/idx24_xau_en_2.gif)

![[Most Recent HUI from www.kitco.com]](/files/idx24_hui_en_2.gif)