Pyramiding - a risky and very profitable strategy

Contrary to what might seem at the first glance, this essay is not about ancient Egypt nor the great creations of architecture in the Central or South America. This article is dedicated to one of the most risky and lucrative strategies ever developed. It might be particularly useful for gold and silver speculators who dare to massively boost their profits.

In this essay, the term ‘pyramiding’ means the strategy of purchasing OTM (out of the money) options, selling them when they are in the money, and using the proceeds from this transaction to purchase another set of options – those, which would be out of the money at that time. In this way you may increase your profits very substantially, naturally, given that your time and price predictions are correct. For example, if you gained 400% by purchasing an ATM (at the money) option and selling it when your predictions materialized, pyramiding might give you staggering 2000% and more. If the chance of realizing such a gain is only little smaller than profiting on ATM options, then you might seriously consider pyramiding. You can use our Position Size Calculator, to check which strategy would suit you better in the long run.

Why do we, gold, and especially silver investors , might be interested in taking so much risk? Well, to put it simply, because we have the possibility of reaping more benefits that pyramiding has to offer, than people interested in other sectors. Pyramiding works best when a particular security moves in a given direction far and fast; and precious metals market (not to mention precious metals stocks!) are known to be extremely volatile at times. Remember the rise in the precious metals at the second quarter of 2006 and the consecutive fall? At such volatile times, this strategy is superior to almost any other. Most of us agree that we have substantial part of this bull market still ahead of us, and that it will get more volatile along the way. There will be times when the price of silver and gold is pretty stable and consolidates in a given trading range, and there will certainly be times when these prices rise at a great pace, outperforming any other asset class. This latter type of price action is just perfect for applying pyramiding! The higher (lower) and the faster gold or silver price rises (falls), the bigger profits you might achieve.

‘What’s the catch? What do you bet on in pyramiding?’

- make sure that your predictions are well founded,

- don’t use too much of your capital (you can use our Tools to check how much is ‘too much’),

- take some money off the table each time you sell one type of options and purchase another one.

‘Isn’t this waaay too risky for me? I don’t gamble with my money, you know.’

Well, believe it or not, including risky strategies to your plans might help you to reduce the overall risk level. For example, you have $2 000 dedicated to your speculative portfolio for purchasing options or warrants. You expect that your ATM options will go up by 400%, but being conservative you attribute this rise a fifty-fifty (50%) chance of materializing. Realizing gains from the pyramid would amount to 2000% here, but the chance is only one third (33%). Let’s see what would be a better decision for your portfolio in the long term. For this simulation we will use our Position Size Calculator (if you want more information about our methodology please refer to our previous essay - The Universal Investor). We are going to check how much profit you would need to expect to justify taking higher risk. If the required profit is greater than 2000%, then pyramiding is useless here. However if it is smaller than 2000%, than it is possible to reduce your risk by using less money to this transaction and still expect higher gains!

Our calculations show that if buying ATM options is your only choice for $2 000, long term optimal fraction you should put in this strategy is 37%, which would effect in part of your portfolio increasing on average to about $18 600 after ten identical transaction. The pyramiding would work best in the long term if 30% was invested each time in such a transaction. Please note that our model by itself suggests lowering your exposure! If you started with $2 000, repeated this transaction 10 times and put 30% each time, then you would end up on average with ...$112 750 (!). That absolutely does not guarantee you such a high rate of return, but it does give you the idea, just how powerful this strategy really is. But – here’s the best part – if you invested only 7% of your capital each time in the pyramid, it would most likely still beat the result of buying simple ATM options. Actually 7% would (on average) cause this part of your portfolio to increase to $22 100 after ten transactions.

Of course, there is no free lunch in the economy and in especially in trading and this situation is no different. It is possible to achieve such high gains because you would ‘bet’ on a different scenario than in the case of purchasing single options of even the underlying security itself. To gain thanks to pyramiding you need to have a price that rises almost without a pause and you have to be precisely right as to how long the move is going to take place, and how high/low the prices are going to rise/fall. The chance for such an accurate prediction to materialize is lower than just for the price of that particular security to rise just by any amount or even without predicting the possible time-frame. However, if you think that if the price is going to rise, and it is almost a ‘sure bet’ that it will go to a certain level without looking back, then pyramiding is very much worth your consideration.

When it comes to the example we just gave you – of course, the risk for each individual transaction is a little higher for pyramiding, but you could use FOUR TIMES LESS capital and still come out ahead in the long term! Let us re-state this: four times less capital for each transaction and chance of winning each time only slightly smaller. That does sound like a substantial decrease in the amount of risk you take on, doesn’t it? It does, and if it still sounds unbelievable we encourage you to go through the last couple of paragraphs or even make these calculations yourself.

When it comes to choosing the stocks on which you might conduct this strategy, the criteria are really very similar to those which you would apply for a simple purchase of options. Preferred are the stocks and options with reasonable liquidity. If you choose to use this strategy on precious metals and PM stocks, then various EFTs and options on them are not a bad idea. Not only are they liquid, but there are many strike prices available, which might better fit your pyramiding strategy.

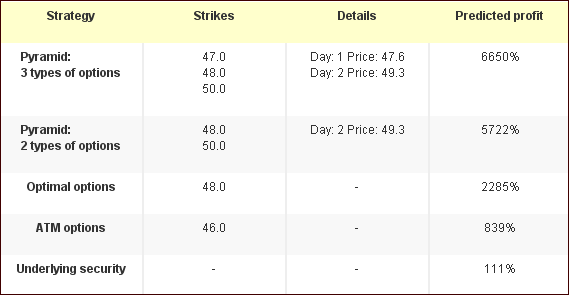

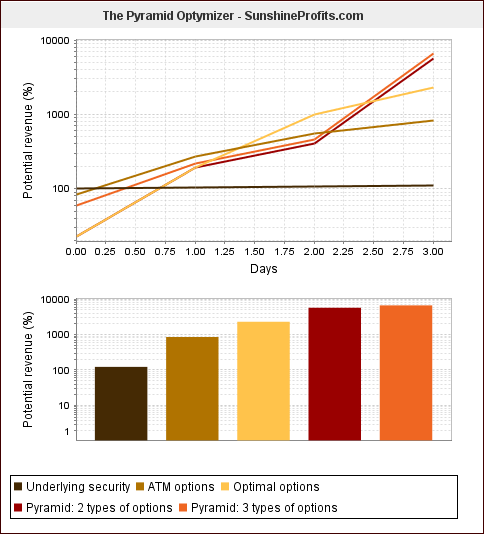

Below we have included an example of what could be done (theoretically) right away. That is just an example of an application of this strategy to the real data, we don’t make any predictions here. This example is very speculative but it clearly illustrates the additional advantage pyramiding can give you. Let’s say that you assume the precious metals market measured by GDX to reach the $51 in four days, just as the May options expire. Taking into account the fact that we use the closing price of May 12-th ($45.98) as the initial price, this is a bold prediction. However similar rise percentage-wise took place at the very beginning of this year. Let’s see how much one could gain on the underlying security, single options on it, and pyramid consisting of 2 or 3 option types if that rise was to materialize right now. This is a chart generated by one of our tools after we entered the data of the options’ specifications and predictions regarding time and the move itself. This means a rise from $45.98 to $51 before May options expire on Friday.

As you may see, pyramiding improves the rate of return, no matter whether you decide to use three types of options of just two. Our model assumes that there will be no increase in the (implied) volatility between as the price rises quickly. Should that be the case, the profitability of pyramiding would decrease at least modestly. The chart below should help to better understand how the profit rises along with the rise in the underlying security for each of the abovementioned strategies.

This model has several assumptions. If you are interested in it be sure to check out the instructions to this tool on our Website.

Before you go and make a killing thanks to pyramiding, you need to ask yourself what strike prices you’re going to use. That depends on many factors, but you usually should be satisfied if the strike prices you use are “somewhere in the middle” between current price of the underlying security and the forecasted price. You might wish to use three or more different strike prices if you predict a really large and fast move in a stock, metal or index. In that case, the strike prices should still be between actual price and the forecasted one, but the differences between them and the starting and final price should be close to being equal. The Pyramid Optimizer, available on our website, can calculate these strike prices for you.

This kind of trade is wonderful to one’s account balance, if it is successfully executed. Yet, there have really been only a few times during the last couple of years when it was rational to really use them. At times, precious metals move in a fast manner, but as we all know too well, we sometimes have long consolidation periods, during which pyramiding really doesn’t make much sense. To achieve very high rate of return you would ideally want a stable market, which starts to move in a given (most likely that would be up) direction and it rises very far. For example, take a look at the magnificent run-up silver had back in the 2005/2006, or the very recent surge that drove the price from $14 to $21. These are the moments you might seriously consider pyramiding. It is also possible to profit on the falling prices, but conducting such a transaction is really challenging.

So – what’s a precious metals investor or speculator to do, to take the full advantage of the outstanding opportunities that pyramiding has to offer?

Firstly, don’t get too greedy. Gold and silver markets are very volatile at times, but that doesn’t mean that they will be volatile each time you make a prediction. In fact – if they were so volatile all the time, the overall profitability of this strategy would decrease – but we don’t want to go into details in this essay. Sometimes it’s best not to take any action and see how things unfold. Be sure to take your position when the chance of winning far outpaces the risk you take on. You may use our tools to help you with this comparison. Either way, we suggest waiting for clear signals before getting involved in this strategy. This could be gold breaking out of some chart pattern, particular positions taken by Commercials or Large Speculators, as indicated in the CoT Report, witnessing excessive fear on the precious metals market, or anything else that would convince you that “the move” is imminent. Let this opportunity come to you. Don’t look at every market action trying to figure out whether that was it or not. Following these rules should make your portfolio safe and more and more sizeable.

At the end of the 1970 – 80 bull market in the precious metals the price of both gold and silver went parabolic and allowed investors to achieve astonishing rates of return. Now imagine that these profits could have been increased at least ten-fold thanks to pyramiding... Another interesting thing is the junior mining sector. Juniors tend to rise very fast at times, especially during the final stage of particular upleg. This applies also to the whole bull market meaning that juniors absolutely thrive in the speculative frenzy when prices of precious metals rise in a parabolic fashion. When precious metals were rising very fast, most juniors were skyrocketing! Now imagine what could have been achieved if you had a portfolio of warrants and used pyramiding on them.

That’s right – you could apply this strategy to precious metals warrants. This is more complicated than using it with options, as there usually is not that many different types of warrants for a given company. You would need to check particular juniors’ correlation etc. to successfully execute this strategy with warrants. We will get back to this issue in our future essays.

The conclusion is that pyramiding is another strategy that gold or silver speculators could use to maximize their profits. If you use it wisely, you can also decrease your overall risk exposure. Like all tools, pyramiding is not good nor bad itself – it can only be used in a good or bad way. This strategy gives you the ability to achieve enormous gains under particular circumstances, but you need to be careful not to overuse it.

On our website you can access the Pyramid Optimizer, a tool that can help you improve your rate of return in using this strategy. Register today and you will gain access to this and all many other Tools. We use the methodology described in this essay as well as many other techniques to forecast market’s moves and discover unique opportunities for profit. When you register, we will send you occasional, brief market alerts, based on our research, whenever situation requires it. Registration is FREE of charge and you may unregister anytime.

![[Most Recent Charts from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_4.gif)

![[Most Recent Copper from www.kitco.com]](/files/idx24_copper.gif)

![[Most Recent XAU from www.kitco.com]](/files/idx24_xau_en_2.gif)

![[Most Recent HUI from www.kitco.com]](/files/idx24_hui_en_2.gif)