The Universal Investor II: Diversifying strategies as a protection against crises.

Several months ago we have written an essay entitled ‘the Universal Investor’ in which we clarified that short-term speculation can be done without much risk even by using very risky instruments. The key to success was very small amount of capital that should be used for such transactions. In this essay we would like to focus on the diversification among different approaches toward earning money on precious metals – short-term speculation and long-term investment. In short, we believe that one can improve his/her risk-to-reward ratio by combining both long- and short-term perspective, as long as the speculative transactions are conducted with long term in mind. The second point of this essay is to tell you our view on the ‘cents to the downside, but that’s not the bottom yet’ situations - as you will see, this is partly analogical to the issues raised earlier.

This topic is especially up to date, given the damage that has been done on the precious metals market recently and many gold and silver investors are trying to time the bottom with a very large part of their capital.

Beginning with our second goal here – we believe that it does not make much sense to wait for the exact bottom as long as we are talking about your long-term holdings. First of all, the chances that a particular investor will buy exactly at the bottom are really low. Of course it depends on what you define as the exact bottom (particular minute, day, week, or month?). The longer time frame you choose, the higher probability of being right you have. Still, the probability does not get past 90% or so, meaning that you can never be sure that this ‘is it’. Being ‘sure’ or as we prefer to view it – having more than 90% certainty – is the characteristic of a long-term investment. As far as these decisions are concerned, you usually have all (most) the fundamental information that you need to make you sure that the market will ultimately go up or down. In our case, for example, one of the reasons that we think this bull market in precious metals is well founded is that the quickly developing countries from the BRIC group (especially China) will put enormous pressure on prices of all commodities. This is true despite local downswings on the Chinese and on the global markets. After all – the economic forces are much less volatile than the leading world stock market indices.

Timing the market is not the matter of fundamental factors. It is usually done by conducting technical and/or cyclical analysis and perhaps combining it with other techniques which are not of fundamental nature. These are often subjective and a considerable amount of doubt is needed before making the final decisions. By this we mean that you should not invest all of your capital based just on the abovementioned analyses. The results can – and sometimes will be – astonishing, but occasionally you will end up with losing your invested capital. It is prudent to make sure it’s not all of it. The point here is that the chance of realizing an outstanding gain is usually not more than 90%; in fact it is often less than 50%. Think about it – if a decision that is not based on fundamentals has relatively low probability of proving profitable, then this is not investment, this is speculation. This means that timing the market, which is done by technical and similar means, should be viewed as speculation regardless of the size of the position that you plan to take. In other words – speculating (high expected rate of return, relatively low probability) does not become investing if you choose to use most of your investment capital to it.

After this introduction, we can get back to the second topic of this essay – the situations, when most investors realize that the bottom is near. You are ‘pretty sure’ that the bottom is near but you don’t know if it will take place right now or in a few weeks. In other words – the probability of picking the bottom is low, but probability of picking the range within which the prices will reverse is much higher. Therefore if you decide to sell/buy a part or all of your long-term holdings (rather (dis)investing than speculation) then we do not advise timing the exact bottom, but instead to try to buy around the bottom. This way you are not likely to get the best price, but you are still likely to get a good price. The important thing here is that you will boost your chance of NOT buying too late or not buying at all. Getting into day-to-day price swings is only for those who have time, nerves and stomach for it. Controlling your emotions is crucial and failing to do so, may result in not buying at all, as you get scared and want to be sure that this is the uptrend. The problem is that it is after the buying opportunity that you get so sure.

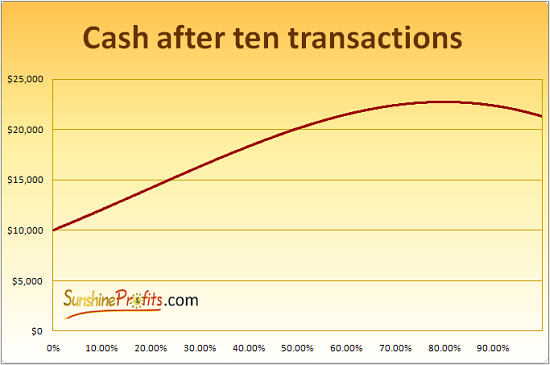

A long-term view on any strategy or approach should be kept in mind at all times. In the long run you will have many opportunities to buy or sell your precious metals or related equities and profit on it. As we explained in the essay entitled ‘the Universal Investor’ – you can assess the long-term effectiveness of your approach toward particular transaction by multiplying it many times (reinvesting in the same transaction over and over again with the same strategy in mind) and checking the results. We have prepared a few simulations for this essay. The first one is checking how much capital you would have on your account after you used different amounts of capital for relatively low-risk transaction with a moderate expected gain. The results can be seen on the chart below. The assumptions made here are: $10,000 initial capital, 10 transactions, probability of gain 70%, realizing gain means profit of 50% and if you are wrong you lose 50% of your capital (means that the market plunges, you panic and sell near the real bottom). This can be viewed as an investment transaction.

As you can see, it more or less pays to use a large portion of one’s capital for such a transaction. Investing about 80% of your capital would give you the best results (on average 8.6% per transaction), but you would still double you capital after ten transactions even if you used only about 50% of it. This would imply average gain of 7.2% per transaction. Using little capital (10% or so) would not hurt you either, but your profits would be very limited.

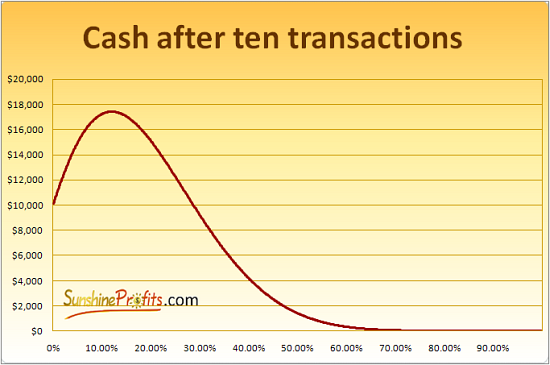

Now, let’s take a look on a situation when you have a small chance of achieving a sensational gain and a big chance of losing the invested capital – for example by buying short term options. Assumptions here are: Initial capital: $10,000, 20% chance of gaining 1000% and 80% of chance losing the invested capital (-100%). This can be viewed as speculation.

Under the abovementioned conditions it only makes sense to use relatively small amount of capital – 12% would be optimal here. If one chooses to use more than about 30%, he/she will be losing money in the long term. It’s just like Evel Knievel (Motorcyclist) once said – ‘risk is good, not properly managing your risk is a dangerous leap’. The 30 percent level is the breakeven point here. As you can see, the charts are completely different for both of these situations, just as your approach should be. Situations like the one mentioned above really do take place – several weeks ago we sent out a Speculative Alert in which we wrote that our models suggest taking a modest position in a risky transaction – and it was right, the trade turned out to be very profitable.

When one confuses both of the situations the results are either bad or worse. The bad situation is when you view the investment as speculation and are too conservative. In this case you risk using too little of your capital and therefore you are limiting your gains to some extent. The good news here is that this will not make you lose money in the long run, only to gain less of it. That is not the case if you view speculation as an investment – that is the worse situation. In this case using too much capital can make you lose money in the long run. If you ‘invest’ large (relatively speaking) amounts of money into short term options, then you might get lucky a couple of times and earn a lot temporarily but you’ll end up with very little if not with nothing. And yes, the chance that you will profit even the first time is small.

A few paragraphs earlier we told you that timing the exact bottom is speculation and picking a broader time-frame is more investment-like. As we have written above taking speculation as an investment is risky and can make you lose money in the long term. Therefore it often simply does not pay to wait for the exact bottom/top with all of your capital, as it damages your financial standing in the long-run.

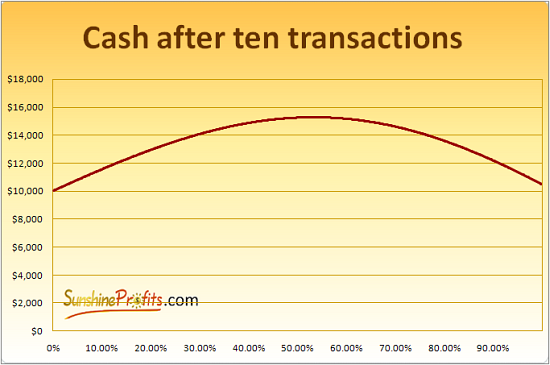

The chart below is comparable with the first (investment) one presented in this essay. This chart and the assumptions made to create it, correspond to a situation described in the earlier part of this essay – when one decides to wait ‘just a little more’ for the exact bottom. This means that gains will be a little higher – 60%, but the chance of realizing them will be a little lower – also 60%.

Although the profitability of a single transaction is higher (60% vs. 50%), the overall long-term gains that could be achieved are much higher in the first scenario (about $13,000 vs. about $5,000). That is if one realizes that the size of the position taken in this way should be lower (about 53% here). If one assumes that timing the bottom is not a slightly different approach and still uses the 80% of one’s capital (as it should be the case with the first scenario), then the profitability is even lower. In this example it would mean a gain of about $3,600 after ten transactions.

It can be argued whether percentages assumed here for particular scenarios correspond to real life situations (why 60%, not 62%?), but the point of this essay is not to give direct recommendations as to what sizes of positions are best at given times. The point is to show you how many things change, when you decide to wait ‘just a little longer’ and make you aware of the consequences that neglecting this may cause. In our view the optimal solution is to make long-term purchases when you know that prices are relatively low, but do not wait for the exact bottom and dedicating some cash to speculation – including timing the exact bottom.

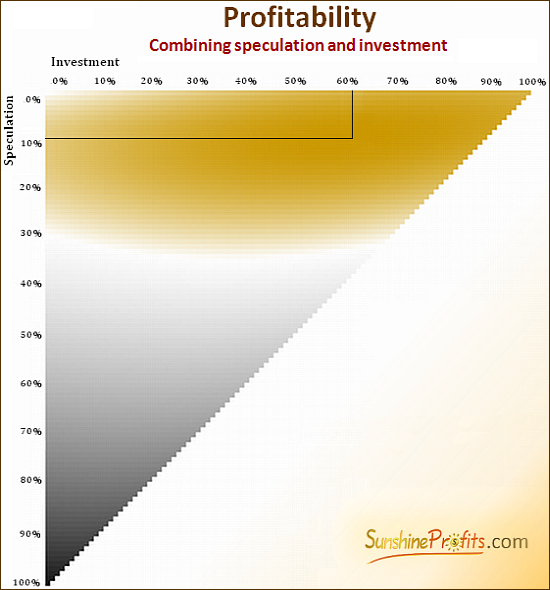

Why do we combine both of these strategies? Because it reduces risk and increases profits. A picture can tell a thousand words (though we doubt that our essays would be get published if they consisted of charts only...), so we prepared another chart to back up the previous statement. Since we have two variables here (the share dedicated to investment and the share dedicated to speculation), it can’t be presented on a linear chart, like the previous situations. We have therefore created a specific area-chart. In this case the x and y axis are variables (particular shares), and the profit is marked with color. White color means that a particular combination gives you exactly no profit and no loss in the long run. The more golden the color gets, the highest profits you achieve at given combination and the more black it gets, the more losses you suffer. The assumptions here are just like the one made earlier: Starting capital: $10,000; Investment: 70% of achieving 50% gain and 30% of suffering 50% loss; Speculation: 20% of achieving 1000% profit and 80% of suffering 100% loss.

Taking a closer look at the chart lets you see that this chart in fact includes two previous charts, as they are the particular cases where either investment share is set to 0% (only speculation) or speculative share is set to 0% (only investment). These can be observed by focusing on how the colors change on the left border and on the top border of the chart. For example the white color is visible at about 30% speculation share and 0% investment share – this is exactly the same 30% that corresponds to the point on the second chart in this essay, where one is at the breakeven point.

The most golden part of the chart (highest profit) corresponds to the 62% (investment) / 9% (speculation) combination of taken positions. Please note that adding it up gives you less than 80% - the amount that should to be put on the table in case one doesn’t want to speculate even with small amounts of capital. What is really remarkable is what an increase in profitability one can achieve in the long term – 11% on average per transaction. This means about $18,500 profit after ten transactions.

Summing up, whether you decide to purchase your precious metals stocks right away, or wait just a ‘little more’, please remember that each of this decisions means a different approach. Please make sure that this is really the approach that you are comfortable with. This goes double for investors, who try to time the bottom/top with a large part of their holdings and/or regret not doing so after the market bottoms. If you decide to mix both aforementioned strategies, like we do, then you might find our services very useful.

One of the tools that we developed (the Position Size Calculator) gives special attention to the success of your portfolio from a long-term perspective. It is designed to optimize a strategy between short, medium and long term options, however you can also use it to calculate positions in the short-term only – for example such as presented above. Register today and you’ll gain access to all our tools and much more. As a Registered User, you will receive occasional, brief market alerts, based on our research, whenever situation requires it. Registration is FREE of charge and you may unregister anytime.

![[Most Recent Charts from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_4.gif)

![[Most Recent Copper from www.kitco.com]](/files/idx24_copper.gif)

![[Most Recent XAU from www.kitco.com]](/files/idx24_xau_en_2.gif)

![[Most Recent HUI from www.kitco.com]](/files/idx24_hui_en_2.gif)