Is your gold stock truly golden? Part 1: The Gold Stocks

By this

"golden" metaphor we mean the stocks that truly are worth being

called the GOLD STOCKS. It's not that these companies are better managed than

other (however that might be the case) or that they have more appealing P/E

ratio than other stocks. The point is that some stocks offer you more exposure

to the price of the yellow or white metal, than others. In this way some gold

stocks might indeed be called more golden than other.

If you invest in the GDX EFT then you might be

specifically interested in the subject, as most of the stocks covered in the

below analysis are included in this fund. In fact only stock that we analyzed

that is not a part of GDX is FCX.

.

Exposure

OK, in order to find out how much exposure to

the price of gold a particular stock has to offer and to compare it with other

companies, we need to choose a way of measuring this exposure. One way to do it

is to dig into company's profile, balance sheet, profit and loss statement,

cash flow statement and other documents and try to establish how high fixed and

variable costs are involved, company's policy, environmental laws and so on and

so forth.

Sometimes, after you would go through all that

papers the situation would change dramatically and/or the market would not

agree with you and value the stock differently for a long time. This is one of

the reasons that we will not use these methods in this essay. Instead we will

adapt a different approach. Let's see what the market thinks about particular

stock. If that's true that all information are discounted in the price then

perhaps we can infer the information we need straight from the price itself. We

can do it by doing some statistical calculations on the prices the market gives

us. We decided that the best measure here would be the R–square coefficient.

From definition (source: Wikipedia): R-square

is the coefficient of determination. It is the proportion of variability in a

data set that is accounted for by a statistical model. In this case R-square

tells us how much of particular gold stock's price is explained by the price of

gold. In other words how much of the stock is exposed to gold or silver and how

much to other factors. Generally, you probably want to invest in a company,

whose price depends mainly on the price of gold, not on any other thing. You

want a company that uses its resources to produce a profit from its precious

metals operations, not from other activities. Of course it makes sense for some

companies to seek alternative profit sources - for example there are times,

when some of the America's biggest car producers would not be making a profit

if it weren't for their financial operations... BUT After all, you wanted a

GOLD stock, right? The closer R-square gets to 100%, the more exposure to

gold a particular company has.

Before we proceed with our analysis of the R–square coefficient, we have to digress a bit.

You have to be very careful when applying

statistical tools and measures to finance. Sometimes the assumptions used don’t

correspond to financial reality. Even if they do or the error you would have

made by using them is really insignificant, you can’t be sure that the model

gives you what you are looking for. It is common that the author of a

particular publication makes the calculations basing on some data, that is not

really relevant, or the reasoning behind choosing a particular model is not

explained to the reader. Not only is

this confusing to the reader as it is more difficult to understand a particular

topic if one does not know what author’s assumptions were, but it can also be

misleading. For example reader might not be aware (Why would he/she? Not

everyone needs to be on the cutting edge of statistics or mathematics) of the

fact that there were actually many models to choose from. Choosing similar (but

different) set of input data could lead to dramatic change in the results and

therefore greatly influence their interpretation.

This article will feature some statistical

measures and their basic transformations. We will try to explain our

methodology as clear as possible in order to avoid any misunderstandings.

Should you have any questions, you can reach us via the Contact Section on our

website at www.sunshineprofits.com

Before presenting results of our calculations we

would like to tell you a little more about the way we constructed our models. Having

a chart or graph in front of one’s eyes always helps in understanding a

particular topic, as you can directly see what the topic is all about. In the following

part of this essay we will give you a brief introduction to the way R–square

coefficient is generally used and provide you with our reasoning behind our

methodology.

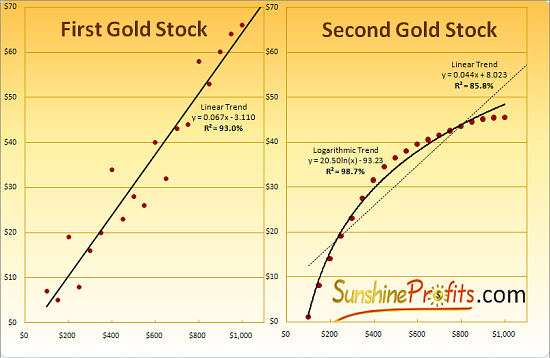

First let us show you how tricky it can be to

focus just on pure numbers. We have already stated that R–square tells you

which stock is explained to the greater extent by the price of gold, so you

should not have any trouble playing a little game with these coefficients. Please

take a look at the charts below. They both represent the relations between two

theoretical gold stocks and the price of gold. We have calculated the trend

lines for linear models for both stocks (on the Second Gold Stock it’s the

thin, dotted line) and respective R – square values. Without looking at the

answer right now, try to answer the following question:

Which of these two precious metals stocks is better explained by the price of gold?

So? What is the correct answer?

If you’ve pointed the Second Gold Stock as the

one that has been better explained by the price of gold, then congratulations,

you were right. The R–square value is higher in case of stock A only, if we

look only at the linear relations. If we allow ourselves to calculate this

coefficient for different models it becomes clear that the amount of “noise” on

the chart with Second Gold Stock is smaller than in case of the first company.

It’s not linear but... Who said the relation between gold and gold stocks

should be linear?! It does not have to be linear. Company’s profit does not

relate so directly to the price of metal itself. It could not, as so many

factors are involved. Both variable and fixed costs differ from company do

company, marketing strategies give different results, management has different

pay schemes and so on. Those were only the differences in profits. Now take

into account different dilution of shares and you get the idea why not always

the assumption of linearity needs to be fulfilled.

Since R–square can be calculated for various

models, we will present you with our results of calculating these coefficients

for best models. Before choosing your favorite gold/silver stocks and putting

your money on the table please note that using R–squares obtained from

different models may be sometimes misleading. R–square as such does tell you

how well this particular model reflects used data. Higher R–square values may

not always mean exactly that a particular gold/silver stock is more influenced

by price of gold/silver (as it was in the case of presented theoretical gold

stocks). If stock A has higher R–square than stock B, it may also mean that

the model applied to stock A suits it better, than the model applied to stock B

suited stock B. Keeping that in mind you need to be careful when comparing

similar values of this coefficient. The table that we will present in this

essay was created using different models – for each stock we chose the best

trend line and calculated R–square for this particular model. R–squares’

comparability is therefore limited. We take the view that you can compare

stocks only if the difference between coefficients is not minor. For example we

would not differentiate between stocks that have R–squares of 71% and 73%,

but we certainly would if they equaled 30% and 80%.

Having said that let’s get to the merit of this

article – we’ll going to tell you which stocks are most influenced by price of gold – in other words those that give you the biggest bang for the buck.

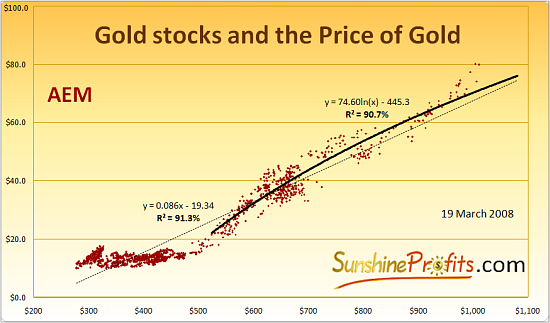

Below you will find chart which shows the relation between the price of gold and one of the well known gold stocks – Agnico-Eagle Mines Limited (AEM). Please take a moment to study the chart before you continue reading.

As you may see, the chart covers data for both gold

and AEM back to the beginning of this bull market, when gold traded below $300,

silver was well below $5 and neither of them was a very popular investment to

say the least. Basing on the price of gold and respective AEM share price, we

calculated and attached the trend lines which best represents the relation

between both variables. Not all of this data is used for each trend line, as

you may see on the chart, but we’ll get back to this later in this essay. Right

now we would like you to focus on the shape of the trend lines. Please note

that the dotted, thin line rises exactly at the same pace for every dollar move

on the price of gold. That is pretty obvious statement, but for the record –

that is a linear trend line. Trend lines don’t always have to be linear. For

example the shorter, thicker line is in fact a logarithmic trend line. This

type of trend line rises at higher pace at lower gold prices but then this pace

declines along with higher prices of gold. We’ve taken into account several types of

trend lines and found that these two are best to represent the data that goes

back to January 2002 for the thin line and January 2006 for the thick line. We’ve

chosen the first date as it represents the moment when both gold and the HUI

index broke out of their long-term downtrends. One may argue whether time

between 2000 and 2002 was still bear market or was it already bull market, but most

people (of course except for the gold perma-bears, who will still deny the

bull’s existence) agree that in 2002 we either began or already were in the

first stage of the bull market in precious metals. So, the share price of AEM for

the entire bull market can be best described using the linear model. We can say

that, because we’ve checked R–square values on the same data for different

models. We’ve chosen from linear, logarithmic, power and exponential trend

lines. All other models gave R–square

values lower than the linear one. R–square of 91.3% means that in this model price of gold accounted for 91.3% of the AEM

prices’ move. This is a very good result in the long term – if you’re

looking for stocks with direct exposure to gold, AEM is sure worthy to be put

into your portfolio.

In the search for coefficient that might better

match current time, we separately calculated trend lines and R–square for shorter

term – for the second stage of this bull market.

In the second stage new groups of investors

enter the market. In this case that would be financial institutions recognizing

the presence of the bull, as well as foreign investors, who see precious metals

appreciate in their local currencies. Since we have different investors, we

might infer that the average way of perceiving risk and leverage associated

with mining stocks will also change accordingly. In our view, we are still in

the early part of this phase, so it makes sense to develop unique tools and

make specific predictions with this stage in mind. This is why our research

towards estimating particular gold stocks’ exposure and leverage to precious

metals will focus on this time frame.

For this, more detailed analysis we will use

the data that goes back to the beginning of 2006. That was the time, when gold

broke out of its trading range in Euro and stayed above previous resistance

long enough to attract new capital. One might argue whether this is precise

time when the second stage of this bull market began (some prefer to think of

the breakout date as the exact beginning) or not, but choosing this date has

also additional advantage to our analysis.

Beginning of 2006 is also the moment when

prices of precious metals reached important levels: $550 for gold and $10 for

silver. Once these milestone were achieved, the price accelerated and peaked a

few months later. Since then we have endured a long consolidation phase, during

which these important milestones have been tested and verified as new

super-strong resistance levels. That gives us reasoning for making the

assumption that we will not see these levels breached to the downside in the

near future - by that we mean at least the second phase of this bull market. Of

course everything is possible in these volatile markets, but some events such

as this one are very unlikely.

The bold line on the above chart of AEM

represents the trend line, which is based on the data exclusively from the second stage of the bull market. This time the trend line is logarithmic and the R–square

value equals 90.7%. It seems that the company might have lost some of its

exposure to the price of gold, but it’s a tough call, as the difference between

both R–square values is really minor. Nonetheless

the true implications of these values

will emerge as we compare them with results for other gold stocks.

We already know what information we might infer

from the value of R–square coefficient, now we have to be sure that we know

what this coefficient does not tell us.

R-square does NOT tell you how much leverage

to gold does a particular gold stock have. It informs you exactly what percent

of past observations (stock prices) have been explained by the price of gold in

particular model and that's it.

Leverage

If you want to know the real leverage you need

to find out exactly how much percentage-wise (theoretically) should a

particular gold stock move if the price of the underlying asset (gold) had

risen by 1%. Choosing simply the coefficient that decides of the slope of the

trend line (0.086 in the case of AEM) as the measure of the leverage for the

whole bull market can be misleading. That means that for every 100 dollar rise

in the price of gold, price of AEM will increase on average by $8.6.

Unfortunately that is not comparable to coefficients of other stocks, as the

nominal prices of stocks are different.

For example if you have stock A that trades at

$100 with slope coefficient of 0.5 and stock B that trades at $1 with slope

coefficient of 0.1, which one of them has higher leverage to the price of gold?

Remember the slope coefficient tells you how much will the stock gain in dollar

terms if the underlying metal rises by one dollar. The answer is stock B. That

is the case, since when gold rises 1$ the price of A rises by 50 cents which is

0.5%, while the stock B would rise 10 cents which is 10% of the stock value. If

you want to be leveraged, which stock would you prefer - the one that moves by

half percent with every dollar move on the price of gold or the one which moves

twenty times more - by 10% percent?

Of course the answer is: Stock B.

Therefore we have transformed the slope

coefficient of AEM’s second stage (since 2006) trend line so that it can be

comparable to coefficients from other stocks. The result is about 1.20% for gold in the $800 - $1000 range. Please note the word “about” – we cannot

say accurately, because is the selected (linear) trend line, the leverage is constant

in dollar terms, but if we take into account the share price and the price of gold,

we get beta, which takes diverse values for different gold prices. In fact,

only the leverage calculated for power trend lines is constant in percentage

terms. In the case of AEM, the beta would be 1.40% with gold at $800 and 1.07%

with gold at $1000. Calculating

leverage for a specific gold price is not much of a disadvantage, since non-linear

models have different slope coefficients for different gold prices, so the

distinction between different prices and following different betas would have

to be made anyway.

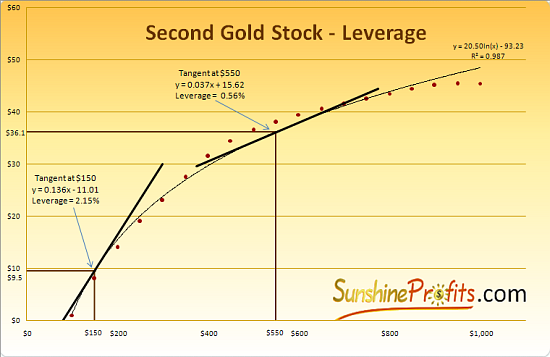

Astute reader might ask about the slope coefficient, as for example logarithmic function does not have one defined slope. This is why we take the slope at exact price of gold. For one, precise point we might calculate the slope coefficient for the tangent of the trend line. Please take look at the following chart – we used the same theoretical data as in earlier example:

Please note how the leverage changes along with

the slope of the tangent, which of course changes along with the price of

underlying metal (gold in this case). Although the price of the Second Stock is

very well explained by the price of gold (R – square = 98,7% ), the leverage

that the company has to offer is very discouraging at higher gold prices. With

gold at $550 the price of this stock will rise on average by about half

percent, when gold moves one percent. One could even say in a sarcastic tone,

that it is the gold that has leverage to this stock, as it outperforms it

without the inherent risk that the stocks carry.

What are the implications of this all this for gold stock investors and speculators? First consequence is quite obvious –

you need to know the time frame for which you want to invest or speculate. In

the above example if the price of gold were at $100 and you would want to bet

your money on the move to the $200, then this stock would be great. On the

other hand, if current gold price were $800 and your strategy was to hold this

stock until gold reaches $1000 then you should probably consider other options.

Our research shows that when it comes to gold

and gold stocks during the second phase of the bull market, they are best

characterized by the linear, power and logarithmic trend lines. Like we stated

earlier, power trend lines mean that the stock’s leverage to metal (gold) does not

change percentage-wise. For other types of trend lines the leverage (beta)

changes along with gold prices.

Here’s how you can deal with these conditions

for different strategies:

For short term trades (for example for 50 dollar

move on the price of gold that you expect to take place within next couple of

weeks) you will not make a big mistake by choosing stocks basing on their current

betas.

For medium term transactions you may also stick

to current betas, as long as you make sure that the leverage will not change

dramatically during your the time you want to hold your position. The table in

the later part of this essay might prove helpful in this approach.

If you plan to hold your stocks for some time

(and take advantage of large upleg in gold) good idea might be to take into

account the leverage for the average price of the metal (for AEM it is

naturally gold). So, if you expect the price to go from $800 to $1200 you might

want to check first the leverage for both $800 and $1200 and then the leverage

for the average price – $1000 in this case. Small difference between the

beginning and end values tell you that the leverage is pretty stable in this price

range and that you really don’t need to make any adjustments – results are

informative enough.

If there is a huge difference between leverages

for a particular stock, you should calculate them manually. That means putting

the initial and final price of gold for your transaction into the equation of

appropriate trend line. Then you have to see how much percentage-wise your

stock would rise and compare it with other stocks for the same rise in the

price of gold. The one which rises most percentage-wise is obviously most

leveraged. You can do these calculations roughly reading the values from the

charts (not precise), you may find in the full version (will be posted soon) of this article or you

can use the Tools section (which we recommend) on our website to get gold stock

prices for any gold price.

Without having proper

(sometimes non-linear) trend lines and without realizing that the leverage

usually changes along with the price, your chance for choosing optimal stocks

for your portfolio is limited.

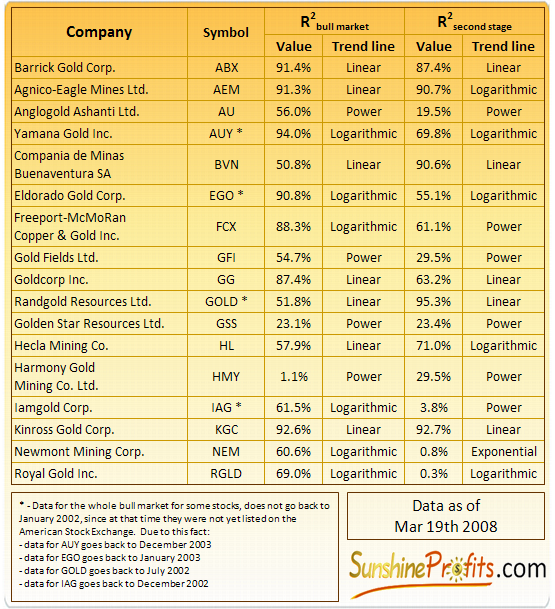

OK, we know what R–square means and what is does not mean. We know how we might estimate gold stocks’ leverage for different durations of transactions. Like we said earlier in this essay, we will now provide you with R–square values and leverages at several prices of gold. Please see the tables below:

As you see, the vast majority of gold stocks

show direct relation to the price of gold in the long term. No wonder – mining

gold is what they do. One company that has surprisingly low R–square value is

HMY. This stock is priced at the same levels now, as it was the case with gold

3 times cheaper. Not really staggering performance up to date. If we looked at

the separate results for the second stage of the bull market would see that some

stocks actually gained exposure to gold (in market’s eyes), for example GOLD

and BVN. Perhaps these companies were undervalued by investors is the first

stage of the bull market, but demand from financial institutions changed this

situation. Some stocks lost much of their exposure to gold. For example RGLD, NEM

and IAG don’t seem to act like gold mining companies at all. Market’s

perception toward these companies has changed dramatically as their prices

don’t reflect movement in the price of the yellow metal. There are times, when

these stocks move in the same direction as the price of gold, but the general

tendencies remain in place. In the case of HMY the R–square increased in the

second stage, but pure numbers don’t say that this stock tends to decline (!)

along with the price of gold and that is the shape of the relation that seems

stronger in the second stage.

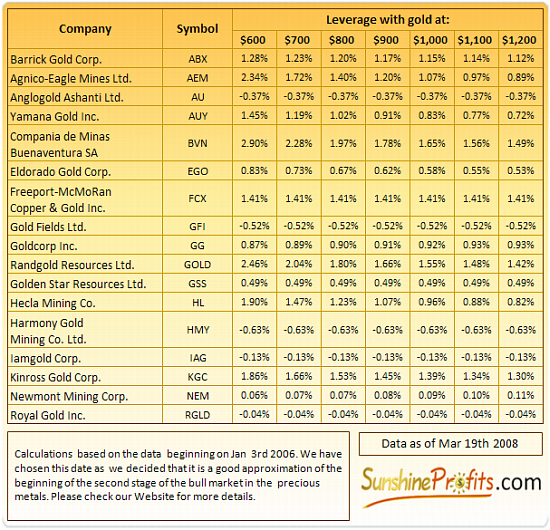

Detailed information about gold stocks’ leverage should make things clear, as to which stocks have a tendency to outperform gold and which don’t. Please see the table below:

The leverage coefficients tell you how much

percentage-wise you will gain when the underlying metal rises by 1% and the R–square tells you what part of this rise may be attributed to the rise in the

price of the metal. All featured leverage values (betas) are standardized for

1% move in the price of given precious metal.

As you may see on the above chart, the leverage

of about half of the stocks is above 1% for gold price of $900, meaning that

you get some extra profits by using these stocks as a proxy for gold instead

investing in the metal itself. Some stocks have leverage below 1% meaning that these

stocks underperform gold on a percentage basis. There are also stocks with

negative leverage. That means that of average they have been declining when

gold was rising. Not very attractive perspective for people seeking exposure

and leverage to gold. Please note that we have included Hecla Mining Company in

our list of gold stocks, though it is usually considered a silver stock – in

fact we will include this company in our research of silver stocks in second

part of this essay. We did put it here, because this company has similar exposure to both

metals – according to the financial statements of the company. By this we mean

that the company gets similar levels of revenue from sales of gold and silver. Also

please note that the sum of R–square values for Hecla for silver and gold may (and it currently does, as you will see in our next essay) exceed

100%. The reason for this situation is that gold and silver are correlated. You

can therefore still use both R–square values to compare Hecla to other stocks

from gold or silver sector. What you should not do is to compare these two

values between themselves with regard to the underlying metal to see which metal has more influence on the price of this stock, as it is not

what these coefficients were originally supposed to measure.

Before you choose your favorite gold stocks

and make a purchase or add to your positions we strongly encourage you to make

additional analysis covering fundamental and technical aspects of these

companies. Also please remember that it’s not a bad idea to diversify your

holdings, meaning that it’s prudent to hold more than just one gold stock.

Although we strongly believe that the

statistical measures used in this essay are very helpful tool in choosing stocks

for one’s portfolio and we use it ourselves, we must inform you about possible

risks involved in using statistics for making your trading decisions. Not all

assumption made in statistical models are necessarily fulfilled in the capital

markets.

If we used statistical tools directly to

trading we would have to be sure that these unrealistic assumptions will not

make us lose our money. They are of lesser meaning if we use this data to

compare stocks between themselves. Even if each calculated coefficient is

biased as a result of assuming normal distribution of returns, it does not pose

a serious threat as long as you only use the results for comparison. If all

results were biased from the same reason, most likely the relations between

them would not be affected.

This is the shorter version of the essay. The full version (containing charts with trend lines for all

popular gold stocks including: KGC, NEM, GG, ABX and more) will be posted soon on our

website at www.sunshineprofits.com

- just browse the Research section in a few days.

Want to know exactly how much will a particular stock have leverage at given silver or gold price? We designed a model that will provide you with that information. Visit our Tools section on www.sunshineprofits.com for details.

![[Most Recent Charts from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_4.gif)

![[Most Recent Copper from www.kitco.com]](/files/idx24_copper.gif)

![[Most Recent XAU from www.kitco.com]](/files/idx24_xau_en_2.gif)

![[Most Recent HUI from www.kitco.com]](/files/idx24_hui_en_2.gif)